Some of my friends are complaining.

Well, to tell the truth, they’re usually complaining, about this or that. But this week, they are complaining about taxes. Property taxes, in particular.

Apparently, the value of an average $350,000 Pagosa Springs home increased somewhat during COVID. To, like, $700,000.

Even old, beat-up homes like mine, without anything getting any upgrades or improvements. The value just skyrocketed, because the house down the street got bought up by… well, I’m not sure who was paying $700,000 for $350,000 houses, but apparently somebody was. Somebody with an overstuffed wallet?

So, when my friends opened their tax valuation letters and found that, in 2024, they will have to pay double the property taxes they paid in 2023, some of them were mildly upset.

It’s not bad enough that prices for everything have been going up, and up, for the past couple of years. (As you may have noticed, dear reader.)

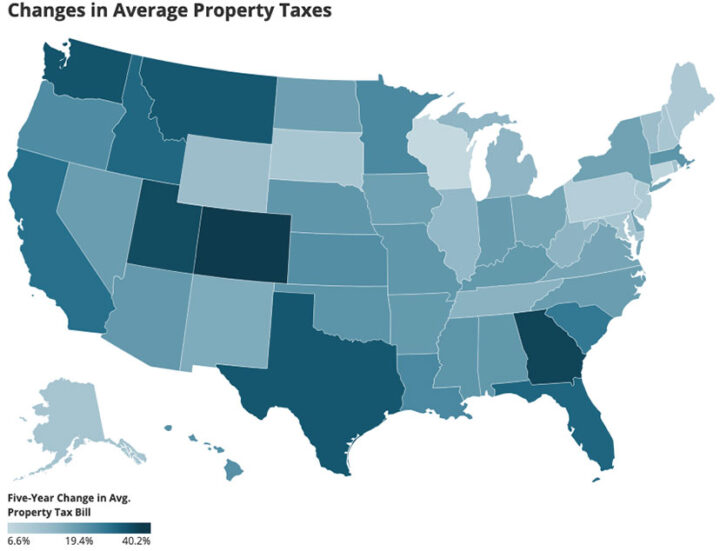

It’s not just a Pagosa tax problem, I hear. It’s happening everywhere. Just not as badly. I found this map online:

The darkest color is Colorado. Between 2016 and 2021, our average property tax increased by 40%. (Actually, 40.2%) The biggest increase in the U.S., by a healthy margin.

Wisconsin saw the lowest increase: 6.6%. But Wisconsin has other problems.

Luckily, I don’t own my house. I rent. Which means my landlord, Ms. Johnson, will have to jack up my rent to cover the increased property taxes. In other words, she will have to bear the guilt. That’s one of the joys of renting.

I read somewhere that the Colorado General Assembly, this year, decided to cut the residential property tax rate from 6.76% down to 6.7%. Thanks, guys.

The Archuleta County Assessor recently published a letter explaining that she didn’t make this happen. The values are the values, and there’s not much a County Assessor can do about it. I believe her, for some reason.

From the Assessor’s letter:

Under Colorado Law, all county Assessor’s offices throughout the state conduct a complete re-appraisal of all properties in their county every two years. There is NO limit or cap on how much property values can go up or down.

Obviously. And as a result, our local governments are going to be collecting twice as much property tax, next year, as they did this year.

The Notice of Valuation for tax year 2023 that you recently received reflects sales from July 1, 2020 to June 30, 2022. This value reflects your market value, or the value we believe you could have sold your land or home for, as of the appraisal date, June 30, 2022. The increase reflected in your Notice of Valuation is a result of historically low mortgage rates, high demand for real estate, increased building costs and COVID-19…

COVID-19 has been a godsend for people seeking excuses for why the world is so screwed up. Without COVID-19, we would probably have to blame this outrageous tax increase on the real estate industry.

As a property owner you have the right to appeal your VALUE, not your TAXES. The County Assessor has NO control over the taxes.

We all have the right to freedom of speech, so we can bitch and moan about taxes all day, and half the night. But technically, we can appeal only our property valuation. This is unfortunate. Most people would really like to appeal their taxes. Am I right?

The Assessor’s goal is to value properties fairly and equitably so that the tax burden is distributed fairly and equitably among our taxpayers within the statutory and constitutional guidelines set forth by the state of Colorado.

Which just goes to confirm the old adage: Life isn’t fair, or equitable.

The Colorado General Assembly may have done one thing right, however. It looks like, just before adjournment of the 2023 session, they passed SB23-108, which allows a local taxing entities to temporarily lower their mill levies. Local taxing entities rarely choose to lower their mill levies (which they can do anytime they want) because in order to raise the mill levy later on, they need voter approval. And we know how voters feel about higher taxes.

SB23-108 would allow the County and the School District and everyone else who lives off our generosity, to temporarily lower the mill levy, and then raise it back up when the property valuations drop back down.

Sheesh. Does anyone really think the property values are going to drop back down?

I’m so glad I’m a renter.