Photo from Unsplash/Jo Coenen.

This article, which appeared on StrongTowns.org on January 3, 2024, is an excerpt from the upcoming book, ‘Escaping the Housing Trap: The Strong Towns Response to the Housing Crisis’, written by Charles Marohn and Daniel Herriges. Pre-order your copy today.

There is a famous saying in financial circles that is generally attributed to billionaire investor Warren Buffett. “Only when the tide goes out do you learn who has been swimming naked.” When easy money stops and financial conditions tighten, those investors holding the riskiest, most fragile positions are exposed.

In 2008, the list of investors swimming naked was long. Among them were America’s banks, big and small. Their reserves were investments believed to be the most secure, including AA- and AAA-rated mortgage-backed securities (MBS). By the end of the year, it was clear those beliefs were wildly wrong.

Any bank would have to recognize a huge loss if they sold one of their MBS. Holding an MBS might subject them to even greater future loss. Mark-to-market regulations required banks to accurately value their portfolios, but with the market for MBS broken, the true mark was unclear. Banks could not even calculate how insolvent they were. Credit markets froze.

The TARP program directed the U.S. Treasury Department to purchase or insure “troubled assets,” the euphemism used for mortgage-related financial instruments that banks needed to unload. The idea was that, by allowing the Treasury to make these purchases, prices would stabilize, even rise, and the assets would no longer be troubled.

That plan was abandoned very quickly. Treasury officials realized that these complicated trading instruments could not be fully understood, let alone properly valued. Also, the list of assets needing purchase vastly exceeded the money allocated. The Treasury had brought a knife to a gun fight; by keeping the knife under wraps, they could pretend it was a gun.

A month after TARP was established, the Treasury Department pivoted. Instead of buying troubled assets, Treasury opted to make direct investments in eight banks. Dramatically, the CEOs of each of these banks were gathered and forced to accept the money, whether they needed it or not. This was a tactic to avoid cascading bank runs. The most fragile banks couldn’t be identified when everyone received support. Troubled assets remained in place.

By the end of 2008, the discount rate was all the way down to 0.5%, kicking off an extended period of what came to be known as zero interest rate policy (ZIRP). It would be more than six years before interest rates moved higher.

Adding to ZIRP’s massive distortion of financial gravity was the Federal Reserve’s Quantitative Easing (QE) program. It was announced the same month as the TARP pivot. With QE, the Federal Reserve purchased MBS directly from Fannie Mae and Freddie Mac. They were able to do this by expanding their balance sheet, creating their own reserves. A less sophisticated way to describe this is “money printing,” a prerogative of financial systems often judged by history as incompetent or despotic.

With QE, the Federal Reserve was able to do what the Treasury Department with TARP could not: create a market for MBS by buying them in unlimited quantities. They bought them from Fannie and Freddie, who continued to buy them from everywhere else. This essentially laundered the market’s questionable securities until prices stabilized. In 2010, commercial banks collectively owned MBS valued at $1 trillion while the Federal Reserve, using QE, owned $1.1 trillion.

This was all initially done in the service of market stabilization. At some point, the goal of stabilization morphed into a new goal: recovery.

In much the same way that the financial tools developed to stop decline in the Great Depression worked to create the post-war expansion, the extraordinary measures taken during the subprime crisis were repurposed to expand the housing sector and the economy along with it.

Yet what exactly did it mean for the housing sector to recover? The period between 2000 and 2008 is called a “housing bubble.” Even the country’s most senior economic officials used that term. So how exactly does an economy recover to a bubble? What is it that is being restored?

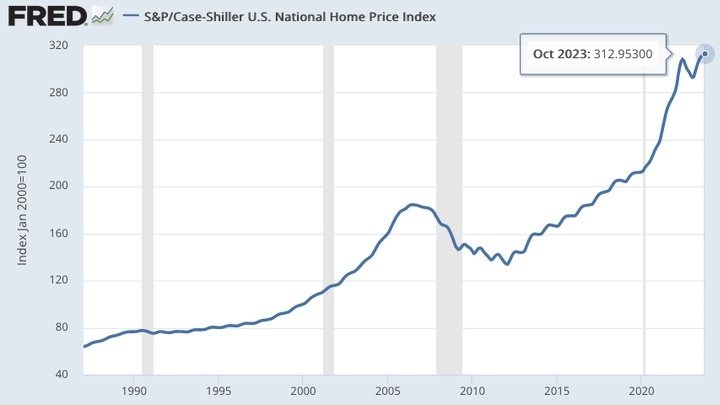

After the subprime crisis, home prices never returned to an historic normal, let alone become depressed. At their lowest point, the Case Shiller Home Price Index was still higher than the levels Stephane Fitch and Josh Rosner called a bubble back in 2001. There was a crash in prices from an unprecedented high, but there was never a depression in home prices.

Here is the Case Shiller Home Index, updated through October 2023. “100” is the indexed price in January 2000.

A financial bubble is, by definition, unsustainable. A post-bubble recovery in the housing market, one that restores it to unsustainable levels, feels like madness. It is the kind of approach a society would pursue only if there were no other choice. The post-crash re-creation of the 2000s bubble demonstrates just how dependent on housing the American economy is.

Mortgage-backed securities still sit at the heart of the banking system. The origination, bundling, and trading of mortgages remains a major source of income for the financial sector. Homes are still the greatest source of wealth for American families. They are a dominant source of revenue for most local governments. Home construction and related industries employ millions. In so many ways, the housing market is the American economy.

A threat to the housing market, therefore, is a threat to the entire economy. With the systems in place today, there is no way for housing prices to broadly return to even 2001 levels, let alone any type of post-war normal, without massive economic disruption.

We can have a growing economy, with low unemployment, but with a financial bubble in housing that makes it broadly unaffordable. Or we can have housing decline to pre-bubble levels and experience another Great Depression.

Either way, many Americans will find it extremely difficult to obtain shelter.

This article is an excerpt from the upcoming book, ‘Escaping the Housing Trap: The Strong Towns Response to the Housing Crisis’, written by Charles Marohn and Daniel Herriges. Pre-order your copy today.