This article first appeared on the Strong Towns website on June 29, 2020. Visit StrongTowns.org.

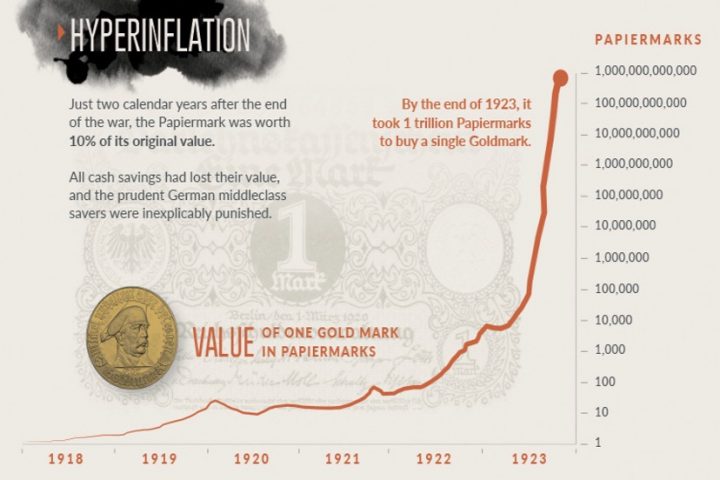

As things went on [in the Weimar Republic following World War I], the dog kept chasing its tail, and the Reichsbank kept printing money. The government, unable to balance its budget, and unable/unwilling to really tax its people, simply printed its way to a balanced budget. They paid wages and benefits to people largely with printed money. They spent money on programs and infrastructure via the printing press. The objective of the government at the time was full employment, and stimulating the economy through government spending of printed marks was how they accomplished it…

In the US, wages have been stagnant for a decade. The stagnation was offset by rising housing prices and the get-rich-quick action in the suburbs. And, of course, the most leveraged and least resilient among us are the first to feel the effects.

Over time in Weimar, as prices kept rising faster than wages, some crazy things happened. Workers started to demand to be paid at the end of each day. There were stories of people ordering dinner at one price and then, because of the rapid inflation, having to pay a different price when dinner was over. Large purchases like new cars became impossible as a 20% down payment would be near worthless two months later when the purchaser was to take possession.

People were desperate to tread water, to simply hold onto what they had. They would leave work after getting their wages and go out and buy anything they could find, knowing that whatever tangible thing they could purchase could later be sold or traded for a higher value. “Growth” was created because people invested wherever they could, lest they hold onto their money and watch its value disappear. From the book by Adam Fergusson, When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany:

As the old virtues of thrift, honesty and hard work lost their appeal, everybody was out to get rich quickly, especially as speculation in currency or shares could palpably yield far greater rewards than labour. While the anonymous, mindless Republic in the shape of the Reichsbank was prepared to be the dupe of borrowers, no industrialist, businessman or merchant would have wished to let the opportunities for enrichment slip by while others were making hay. For the less astute, it was incentive enough, and arguably morally defensible, to play the markets and take every advantage of the unworkable fiscal system merely to maintain one’s financial and social position.

As that position slid away, patriotism, social obligations and morals slid away with it. The ethic cracked. Willingness to break the rules reflected the common attitude. Not to be able to hold on to what one had, or what one had saved, little as it worried those who had nothing, was a very real basis of the human despair from which jealousy, fear and outrage were not far removed.

[Note from 2020: We can see the mirror image of the Reichsbank “prepared to be the dupe of borrowers” in our Federal Reserve, which is buying near-junk corporate debt from companies that would disappear without Fed generosity, and will certainly go away once it ends. And in a stock market that has experienced its greatest rise in history during a global pandemic (amid other calamities), we have recreated the conditions whereby no investor “would have wished to let the opportunities for enrichment slip by while others were making hay.”]

While early on the dollar would trade for 5 marks, by the end it fell to one dollar for 4,200,000,000,000 marks, the entire economy reduced to barter and foreign currency. Unemployment spiked as the inflation-driven investments were revealed for what they were: worthless.

As I said earlier, while the pace picked up at the end, this decline all happened over many years. There were a number of opportunities that politicians and others had to put the brakes to this disaster. Nobody could. This also eerily has a tinge of our current political situation. From the book:

Much as it may have been recognized that stability would have to be arranged some day, and that the greater the delay the harder it would be, there never seemed to be a good time to invite trouble of that order. Day by day….the reckoning was postponed, the more (not the less) readily as the prospective consequences of inflation became more frightening. The conflicting objectives of avoiding unemployment and avoiding insolvency ceased at last to conflict when Germany had both.

We can see ourselves in many ways in that fear of the tough reckoning. While many politicians talk tough, they reflect our unease. Are we really prepared to deal with the suburban malinvestment of the past two generations? Are we prepared to undergo the difficult transformation in our living arrangement and the massive decline in our standard of living required to face up to our core insolvency and lack of productivity? Knowing that we aren’t helps us see that the German policy of inflation — kicking the can down the road — was not so crazy at the time.

Even so, the result is no less predictable. From the book:

What really broke Germany was the constant taking of the soft political option in respect of money. The take-off point therefore was not a financial but a moral one; and the political excuse was despicable, for no imaginable political circumstances could have been more unsuited to the imposition of a new financial order than those pertaining in November 1923, when inflation was no longer an option…. Stability only came when the abyss had been plumbed, when the credible mark could fall no more, when everything that four years of financial cowardice, wrong-headedness and mismanagement had been fashioned to avoid had in fact taken place, when the inconceivable had ineluctably arrived.

As a final thought here, it was also important to note in this book that, as the tough decisions got put off further and further, the solutions obviously became more difficult. As the needed medicine became more distasteful, the politics of the day became more extreme. In Germany of 1923, you had the communists on one side and the national socialists on the other. Their numbers grew as the situation became more desperate, as the pragmatic kick-the-can strategies simply put off and compounded the inevitable reckoning. The communists were for the worker, the Nazis for the industrialists. In the end, the workers lost their jobs and the industries all went bankrupt.

Inflation is the ally of political extremism, the antithesis of order. At other times — in post-revolutionary Russia, in Kadar’s Hungary — it may have been deliberately engendered in order to destroy the social order, for chaos is the stuff of revolution. In Germany at this time, however, the inflationary policy was the consequence of financial ignorance, of industrial greed and, to some extent, of political cowardice. It therefore produced hothouse conditions for the greater and faster growth of reactionary or revolutionary crusades.

Of course, we know how that all tragically ended in Germany.

We have a lot to ponder in this country. A lot to discuss. And we have a lot of really difficult decisions to make. It will be politically easier in the near-term to continue to debase the currency, to pretend that we are making good on all of our obligations while continuing to expand our empire, with inflation providing the illusion of prosperity. It will be very tempting to restart the suburban experiment by resetting our private debt levels through inflation. Is this just postponing the inevitable?

Incidentally, after Germany had “plumbed the abyss” they restored their currency by a) stopping the printing press, and b) issuing new currency that was fully backed by and exchangeable for gold. For the United States, the fragility of our suburban experiment is compounded by our experiment with fiat currency (we went off the gold standard in 1971)…

Never has the world held one reserve currency that was not backed by anything but “good faith and credit.”

We may need more of both soon enough.