Those with a savings plan are twice as likely to save successfully. Taking the America Saves Pledge is a pledge to yourself to start a savings journey and America Saves is here to encourage you along the way…

— from the AmericaSaves.org website.

I didn’t know, until I came across the America Saves website, that there were ‘successful’ ways to save. Which of course implies that there are ‘unsuccessful’ ways to save.

I seem to be something of an expert on the ‘unsuccessful’ ways.

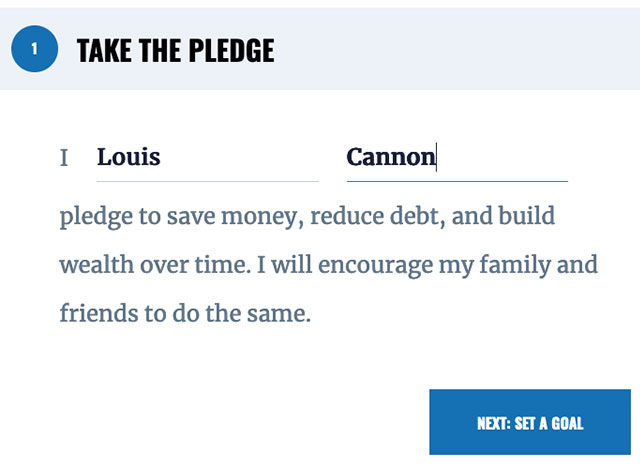

In an effort to help me save successfully, America Saves was willing to take me on as a client, even offering me a chance to take the Pledge. All I had to do was enter my first and last name, and click a blue button to “SET A GOAL”.

Successful saving, I thought, is going to be a lot easier than I imagined. I especially found the phrase, “build wealth over time”, to be attractive.

Hopefully, not too long a time.

Come on, family and friends! Let’s build wealth together!

I was slightly confused, however, by the next step.

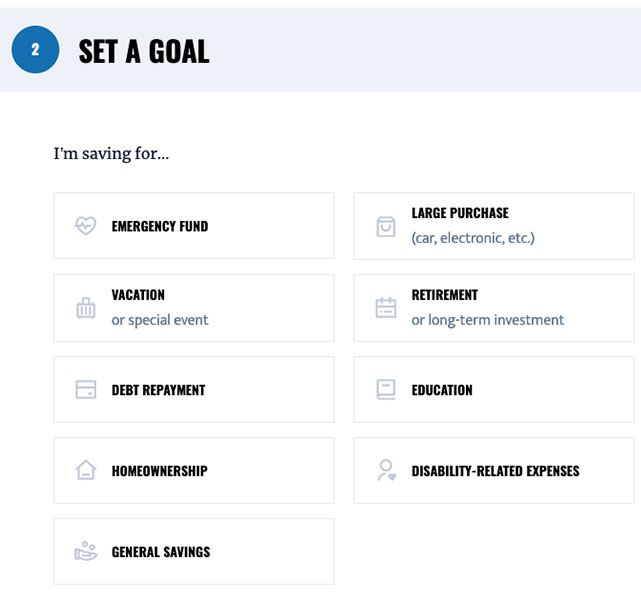

When I clicked the blue “NEXT: SET A GOAL” button, I was shown these options:

How does a person pick from this list? I want all of these things, except maybe disability-related expenses. (Although you never know.)

And not for education, either. Education is overrated. In my experience.

But all the other choices! Hell, yes, I would like a hefty (and successful) savings account for each one of those purposes.

But America Saves was allowing me to save for only one thing. They didn’t want me to save for all of them. “Pick only one, Louis”, they were telling me.

Which might be the key to successful saving? Keeping your expectations low?

So I picked “Vacation or Special Event” which in my case would be a “Vacation” rather than a “Special Event” which I understood to mean “a Wedding”.

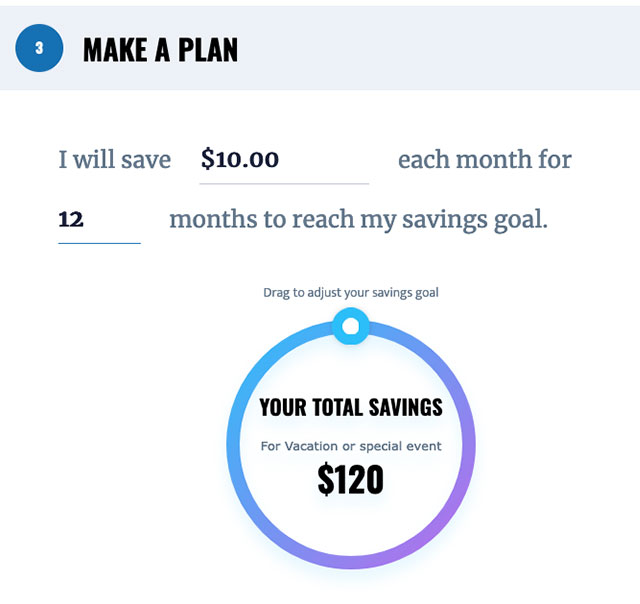

On the next screen, I typed “$10” into the first blank, and “12” into the second blank.

Because I pretty much live paycheck to paycheck, I figured I could afford to save about $10 a month, and maybe take a vacation after 12 months of saving. Apparently, my vacation will cost about $120. In other words, I will be camping out in my backyard, and ordering take-out from Chavolos Taqueria. (They deliver.)

Honestly, that didn’t sound very appealing. Although I do like the food from Chavolos. But camping in the backyard? And listening to the neighbor’s dog bark all night?

So I switched to my second choice: “Debt Repayment”. (They let me change my mind.)

When I clicked that button, the screen opened with the “$10 each month” already filled in. The website already knew what I could afford.

Then I thought, this is stupid. Why would I ‘save’ to pay off my debts? Why not just simply pay off my debts?

At this point, I started wonder: Who are these people? Do they really know understand anything about saving successfully?

I mean, yes, the website buttons work, and the calculations seem accurate. But when I first pledged to “to save money, reduce debt, and build wealth over time…” I figured they were going to seriously help me out. Like, send me some money?

Because that’s what I really need, to start saving successfully. More money.

It took a bit of searching to find out that ‘AmericaSaves.org’ is a project of the Consumer Federation of America, an association of non-profit consumer organizations, established in 1968 to “advance the consumer interest through research, advocacy, and education.”

The CFA website doesn’t say anything about giving away money to potentially wealthy people like me. And a bit more searching revealed the possible reason.

Apparently, in 2017, CFA had an income of about $3.4 million… and assets of nearly $9 million.

By 2021, their income had dropped to about $2.6 million and their assets to about $6 million.

Looks like they lost maybe $3 million in assets since 2017.

Not exactly the way to build wealth.

Reminds me of my dad, when he used to tell me, “Louis, do as I say… not as I do.”

Underrated writer Louis Cannon grew up in the vast American West, although his ex-wife, given the slightest opportunity, will deny that he ever grew up at all. You can read more stories on his Substack account.