Earlier this week, I watched an entertaining YouTube video explaining one of the reasons many Americans are too broke to buy a home.

Orlando Miner’s 11-minute YouTube provided an entertaining exposition of the many hallmark traits of “Lifestyle Creep”.

Mr. Miner shared his colorful view on what happens when a consumption-driven economy begins to think, behave, and spend on nonessential items as a ‘right’, rather than a ‘choice’.

His YouTube is a fast paced, charismatic narrative on what happens when consumer spending decisions and attitudes are “I deserve it”, rather than thinking about the opportunities that saving money can provide.

Examples of ‘Lifestyle Creep’ may include:

- Taking luxury vacations

- Eating out more frequently and more expensively

- Buying or renting more house than you need (or a second home)

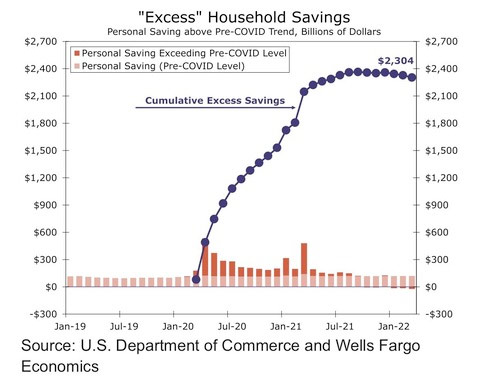

It was that last example of Lifestyle Creep, that really caught my attention… because in the YouTube Orlando discussed an “Excess” in Home Savings chart published by the U.S. Department of Commerce and Wells Fargo Economics.

I wonder how many of the 1,042 STR in Archuleta County were purchased as a direct consequence of ‘Lifestyle Creep?’

If “Excess” Household Savings is now being depleted, perhaps some of the (passive income producing) second homes will stop being “shadow inventory”, and become affordable long-term shelter in Pagosa Springs.

A Daily Post reader recently emailed me that she used Zillow (For Sale, For Rent), and AirDNA (STR Inventory) to confirm 55 homes available For Rent, 486 homes available For Sale, and 1,042 homes held as STR inventory.

Orlando’s YouTube video helps to explain why if more MLS (For Sale, For Rent) is made available, perhaps with a slow-down in Lifestyle Creep (thinking, behaving, and spending), more affordable home ownership might become available.