I mentioned on Monday, in Part Eight, the concept of “backfilling” a County budget, and said this unfortunate process had apparently taken place during the five-year duration of the Ballot Measure 1A tax increase. The Archuleta Board of County Commissioners had asked the voters, in 2006, to grant them five years of higher taxes, to allow major investments in road maintenance.

I was one of the majority who had voted “Yes” on 1A.

Also, during 2006 and 2007, the County suffered a serious budget crisis, when about $2.5 million went “missing”. (I have never heard a credible explanation for where the $2.5 million disappeared to.) Needless to say, the County budgets, then, were something of a mess.

Also yesterday, the local activist who had documented this “backfilling” process in 2011 emailed me his research, with the graphs that better illustrate what happened.

He wrote:

I am a firm believer that history points to the future. In 2006, we passed 1A with the belief road funding would increase.

Unfortunately this didn’t happen.

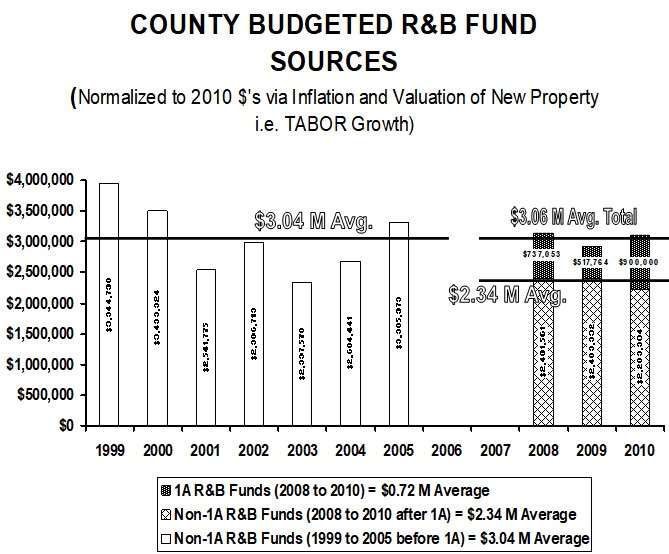

If one corrects for inflation and growth, the County budgets show an average expenditure of about $3.04 million per year on roads during years 1999 to 2005 — before the 2006 1A road moneys were available. After the 2006 1A issue passed and moneys began to be collected, the County budgeted an average of $3.06 million per year for roads during the 2008 to 2010 time frame… even counting the extra average of $720,000 per year in 1A moneys. Figure 1 shows the budgeted road and bridge (R & B) fund for years 1999 to 2010. (Years 2006 and 2007 were excluded from analysis due to the questionable budget process used during those years.)

Yes, the County benefited from the 1A tax increase to the tune of about $720,000. But when the budget amounts were adjusted for inflation and property value increases, it appeared that the County was spending only about $20,000 more on roads in 2008-2010, compared to 1999-2005.

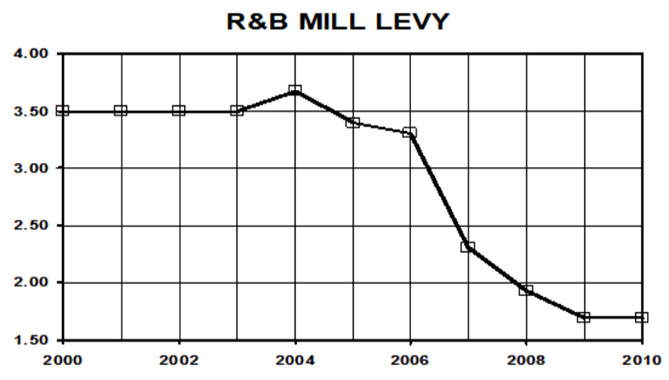

This apparently happened because the BOCC reduced the amount of the existing (permanent) mill levy applied to the R&B budget.

So… where did the additional $700,000 per year from 1A … that was supposed to be spent on roads… actually go?

To more employees, perhaps? In the midst of a budget crisis?

My friend wrote:

Commensurate with the increase in the General Fund — at the expense of the R&B fund — there was a substantial increase in County staff to levels prior to the 2007 budget crisis. Figure 3 shows the budgeted County staff growth from 2003 to 2011.

As I mentioned before, County spending and budgets are complicated, and the way our money gets used is not always apparent, even to the commissioners.

To compound the problem, the people sitting on the BOCC change on a regular basis, and the attitudes, spending priorities, and politics can change radically as each new commissioner is elected. We currently have two commissioners and a County Manager previously employed by the Archuleta County Sheriff. Our Daily Post readers may have noticed the rather generous spending on jails, courthouses and Sheriff’s facilities over the past four years, in spite of two “No” votes from the taxpayers.

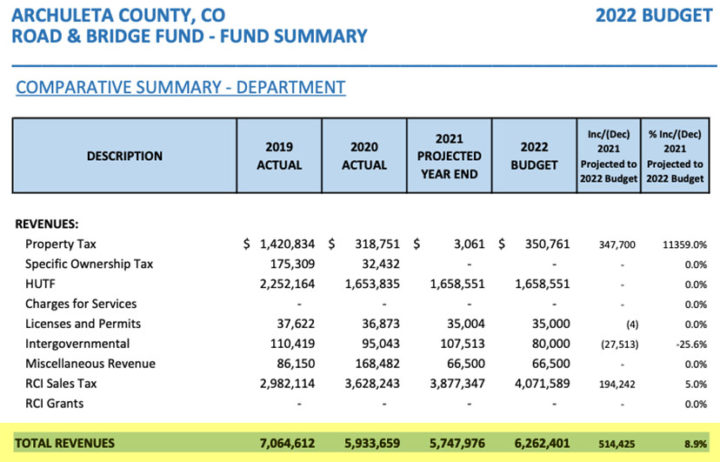

Readers may also have noticed that the revenues used for Road & Bridge (R&B) have been reduced below previous levels by our current BOCC. In 2019, the BOCC had allocated $7.0 million for R&B. Since then, the average allocation has been about $5.9 million.

Since 2019, the total expenditures made by the County as a whole, have increased from $33.6 million to $47.8 million. That’s a 42% increase…

…but they’re allocating less revenues to roads than in 2019?

The commissioners seemed surprised when Magellan Strategies consultant Courtney Sievers revealed the unsettling fact that only 4% of the respondents in Magellan’s August voter survey strongly agreed with the statement: “Archuleta County is fiscally responsible and spends taxpayer money wisely.”

Some of us were not surprised.

In spite of their surprise, however, the BOCC voted unanimously to ask the voters to increase our sales tax burden, and give the BOCC another $70 million – $90 million over the next 10 years.

We will have a chance to vote “Yes” or No” this coming November. (Mail ballots will go out in mid-October.)

But let’s shift gears slightly, and consider some U.S. history. Back in 1913, Congress ratified the Sixteenth Amendment to the U.S. Constitution, granting the federal government the power to tax incomes. At the beginning, the tax rate was 1%, and applied only to persons earning more than $3,000 a year — equivalent to about $90,000 in 2022 dollars.

The Amendment is not complicated:

The Congress shall have power to lay and collect taxes on incomes, from whatever source derived, without apportionment among the several States, and without regard to any census or enumeration.

Apparently, the federal income tax was created as an end-run around a corrupt system of ‘revenue tariffs’ — import taxes that drove up the price of foreign goods, to benefit domestic companies and farmers — and also provided the largest share of the federal government’s revenue stream. Because of the complexities of international trade however, a revenue-generating tariffs provided opportunities to extend heavy protectionism to politically connected industries, by selectively imposing high rates on their foreign competitors.

Tariff schedule revisions in the 19th century became a political free-for-all of bribes, backroom deals, and favor trading.

The Republican majority in Congress didn’t mind the bribes, deals and favor trading, it seems. But the Democratic minority, led by Sen. Joseph Weldon Bailey of Texas, came up with a bold scheme, to replace the ‘tariff revenue’ with fresh revenue from a federal income tax. The Democrats held only 32 out of 92 Senate seats, which meant they would need to peel away approximately 15 Republicans to back the income tax. This task was actually feasible. The Republican ranks included about 10 to 12 progressive “insurgents” who favored more expansive taxation to finance social aims, and who signaled an interest in supporting the income tax.

Through a complicated process, Sen. Nelson Aldrich of Rhode Island — the best buddy of the East Coast industries benefiting from tariff protections — pushed through a (even more corrupt?) tariff schedule revision. But to get the necessary votes, he had to promise to support a Constitutional amendment authorizing a federal income tax.

It appears that the Congressional majority, in 1913, backed the Sixteenth Amendment to free trade… believing that the proposed ‘revenue swap’ would finally break the stranglehold the corrupt protectionists had over the federal revenue system.

My point in sharing this interesting bit of history is to remind our local leaders, and our local voters: there is more than one way to skin a cat. Or even, to skin a couple of cats.

Those cats being, here in Pagosa Springs, a failing road system, and a serious housing crisis.

Our roads are in generally poor shape and the BOCC, historically, doesn’t seem capable of managing the situation. Nor have they successfully addressed the housing crisis. They’ve built new County facilities, hired more employees, and increased salaries… instead of doing what we want them to do.

Ideas, anyone?