Of all the ballot propositions we’re voting on, one in particular is designed to put taxation control in Colorado back into the hands of the people. And that’s Proposition 117… Frankly, this could go further, but dismantling the government’s insatiable appetite for wanting to grow is a long-term process.

— from a letter to the editor of the Highlands Ranch Herald, by Colorado resident Robert Hessler

Educators, parents, and education advocates are raising concerns about Proposition 117, a confusing and vague proposal on the 2020 ballot. The ballot question restricts the use of state enterprises, which include unemployment insurance and college savings accounts, and jeopardizes funding for essential programs. If 117 passes, state legislators would be forced to ransack the state budget and slash current funding for education to pay for other critical services…

— from an email sent out by Frank Valdez, Colorado Education Association

As with almost any political issue, the Proposition 117 coin has two sides. In this case, the two sides are, essentially, ‘taxpayer control of government spending’ vs ‘government control of government spending’.

Looking at the two arguments shared at the top of this editorial, the one that appears closest to the truth is Mr. Hessler’s letter. Proposition 117 is indeed an attempt to put taxation controls back into the hands of “the people”. According to the non-partisan state ballot information booklet (The Blue Book):

A “yes” vote on Proposition 117 requires voter approval for new state government enterprises with fee revenue over $100 million in the first five years.

There is nothing in the language of Proposition 117 that suggests — as Mr. Valdez and the Colorado Education Association would have us believe — that this new law would cause anyone to “slash current funding”. As clearly stated in the Blue Book, Proposition 117 will place controls on new government enterprises, created in the future, not on existing programs and agencies.

Do the taxpayers want better control, in the future?

Back in 1992 — the year before I moved to Pagosa Springs from Alaska — the people of Colorado set out on a grand experiment by approving an amendment to the state constitution known as TABOR: the Taxpayers Bill of Rights. We had been hearing about the threat of “Big Government” ever since Ronald Reagan’s first inaugural address, when we heard him describe the nation’s core problem this way:

But great as our tax burden is, it has not kept pace with public spending. For decades we have piled deficit upon deficit, mortgaging our future and our children’s future for the temporary convenience of the present. To continue this long trend is to guarantee tremendous social, cultural, political, and economic upheavals…

The economic ills we suffer have come upon us over several decades. They will not go away in days, weeks, or months, but they will go away. They will go away because we as Americans have the capacity now, as we’ve had in the past, to do whatever needs to be done to preserve this last and greatest bastion of freedom.

In this present crisis, government is not the solution to our problem; government is the problem…

“The present crisis” in 1980 was a country struggling with a recession, spiraling interest rates, increased oil prices, and a disturbing rate of inflation accompanied by high unemployment. Despite his rhetoric, however, President Reagan oversaw the biggest deficit increase of any President since Franklin Roosevelt. Under President Reagan, federal debt increased by 186%, and the US military grew by 35%. Reagan talked a good game, but government spending overall — federal, state and local — grew by more than 7% during his watch, when comparing government spending to population.

And it grew by a similar amount under GHW Bush, and under Clinton, and under GW Bush. (Somewhat less under Obama.)

In 1992, when tax activist Douglas Bruce and his colleagues proposed to slow the growth of state and local government spending in Colorado with the Taxpayer’s Bill of Rights, it appears that a majority of Coloradans subscribed to Ronald Reagan’s diagnosis — that we’re better off when government is limited. TABOR (theoretically) limits the growth of government spending by tying any increase to inflation and population growth. TABOR also required our state and local governments to obtain voter approval for any long-term government debt.

Colorado voters approved TABOR with 54% “Yes” vote.

But it didn’t take our elected and appointed government officials very long to figure out ways to grow government without “raising taxes”, because TABOR did not restrict the growth of government “enterprises”. A government enterprise is, in essence, a public business that provides services and charges fees for those services. Most water and sanitation districts, for example, are ‘enterprises’ that charge customers a monthly fee. Under Colorado law, an ‘enterprise’ cannot receive more than 10% of its income from state and local taxes.

But the Colorado legislature has created some very unusual ‘enterprises’ that charge fees to everyone, regardless of whether they receive any direct services from the ‘enterprise’. Some critics have argued — in the media, and in the courts — that many of these ‘fees’ are actually taxes in disguise, and ought to be subject to TABOR rules. For a thorough discussion of fees and enterprises in Colorado, you can download a 42-page analysis by researcher Joshua Sharf, published by the right-leaning Independence Institute.

From an October 5 article by reporter Brian Eason in the Colorado Sun:

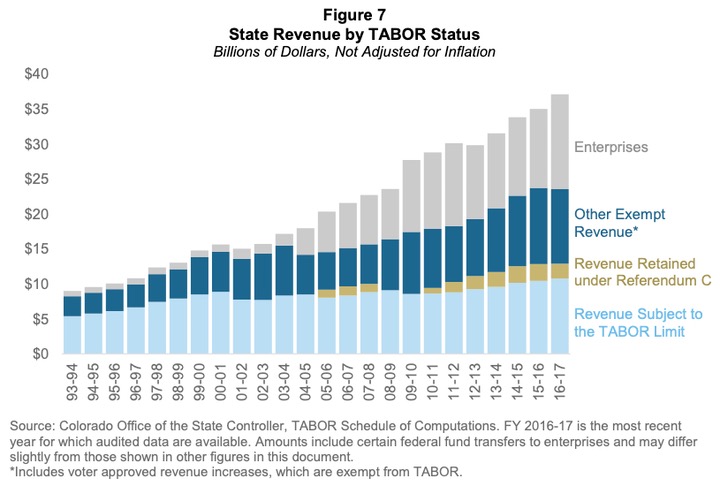

There’s no doubt that the growth of enterprising has been staggering. Just after TABOR took effect in the 1993-94 fiscal year, enterprise funds generated $742 million, which was just a fraction of the state’s total budget. In 2017-18, according to an analysis by Colorado Legislative Council, they generated nearly $18 billion. But not all of the total comes from fees. In the 2018-19 fiscal year, according to a separate legislative analysis, fee revenue collected by state enterprises made up around 20% of the state’s roughly $29 billion budget.

Here’s a graphic from the December 2018 state report from the Joint Budget Committee, Colorado Legislative Council, showing how state revenue has shifted to sources outside TABOR limits in recent years — and grown substantially as a result. The gray bars represent the fees collected by so-called ‘state government enterprises’.

Unlike TABOR and certain other constitutional limits, Proposition 117 is a statutory change, meaning that lawmakers could override it by passing legislation. But there would be political risks in doing so… if voters approve it on the ballot on November 3.