A plan shared by La Plata Electric Association, in a public Town Hall meeting on October 25, would result in half the electricity coming from electricity cooperative Tri-State Generation and Transmission, the current wholesale supplier, and the other half from Crossover Energy Partners, a private company.

Crossover was selected as the finalist for LPEA’s new supply partner, out of the nine suppliers who had responded to LPEA’s Request for Proposals. As of this past summer, Crossover had deployed more than $4.7 billion in renewable assets with a power generation capacity of 12.5 gigawatts, with five offices nationally, from New York to San Francisco. In June, it gained financial backing from investment firm KKR (formerly Kohlberg Kravis & Roberts). Crossover was described as the “exclusive energy transition solutions partner for KKR.”

Tri-State has historically invested heavily in coal-fired generation, making it less attractive as a supplier among environmentally-conscious electricity co-ops. It retains its attractiveness, however, as a transmission partner.

Hence, a potential ménage à trois in our energy future.

The agreements with Tri-State and Crossover are still in the negotiations stage, by the preliminary plan suggests increased access to renewable electricity generation for LPEA customers, and possible cost savings, as renewable electricity generation continues to fall in price — while the environmental and financial cost of coal generation continues to remain high.

Over the past few years, LPEA and seven other rural electricity cooperatives in Colorado, New Mexico and Nebraska have been exploring financially viable ways to get out of their long-term supply contracts with Tri-State. The Kit Carson cooperative in Taos, MN bought their way out of their Tri-State contract in 2016, paying a $37 million exit fee. The Delta-Montrose co-op paid a substantially larger exit fee — about $63.5 million — to sever its relationship with Tri-State in 2020.

Other co-ops eyeing the exit door have included United Power, Tri-State’s largest member, with 103,000 customers. LPEA has about 55,000 member-customers. At one point in LPEA’s exit negotiations earlier this year, we heard the figure $449 million thrown around as a possible price for completely leaving Tri-State — a non-starter — but LPEA was conducting simultaneous negotiations focused on a partial contract buy-out.

At LPEA’s October 25 and 27 Town Hall meetings, a potential plan for splitting electric power acquisition between Crossover Energy Partners and Tri-State was explained in some detail by Dan Harms, LPEA vice president of grid solutions. The second half of each hour-long Zoom meetings was dedicated to answering rather intelligent questions from the public.

You can watch the hour-and-eleven-minute October 25 meeting here, on YouTube.

Here are a few of the slides shared at the meeting.

This chart shows the somewhat incredible drop in the cost of new solar installations since 2009, compared to new coal and natural gas installations. (Levelized costs include the cost of installation, the cost of operations and maintenance, and other cost factors.)

The above slide summarizes the LPEA (and Tri-State) response to the rapidly revolving changes in energy markets resulting from the steep decline in the cost of solar generation. Tri-State has made a significant commitment to retiring its (outdated?) coal-fired plants, and has promised to replace them with renewable energy generation over the next few decades, but LPEA is looking for a faster transition to green energy — something that Crossover has promised to deliver.

During the Town Hall meeting, Tri-State Chief Financial Officer Pat Bridges explained that Tri-State’s planned retirement of coal-based plants will be made easier if LPEA starts buying some of its electricity from Crossover. “The partial contract option can be a win-win for La Plata and other coops, and Tri-State and the generation and transmission business model,” Mr. Bridges stated.

In January 2020, Tri-State CEO Duane Highley announced the company would be decommissioning its coal assets in Colorado during the coming decade for cheaper generation, especially wind and solar. The option to allow local co-op members negotiate ‘partial-requirement’ contracts with Tri-State was developed in April 2020, allowing members the flexibility to significantly increase the local renewable energy development and otherwise choose how to satisfy up to 50% of their power needs.

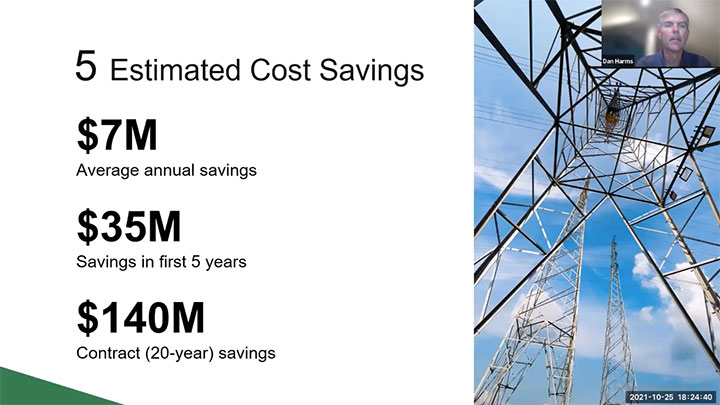

LPEA has made no commitments to the “50-50” purchasing arrangement beyond a memorandum-of-understanding with Crossover. If the plan goes forward, said Mr. Harms, the switch would likely occur sometime in 2023. A 20-year contract being negotiated would require Crossover to deliver power to LPEA and develop local renewable resources. LPEA would have set prices, and Crossover would agree to generate 75% from renewable sources. Mr. Harms indicated that the contract being negotiated could result in $7 million average annual savings for LPEA.

About 450 LPEA members participated in the virtual Town Hall meetings.

Tri-State currently has generates about 35% of its electrical production from renewable sources, but expects to hit 50% by 2024. Meanwhile, Tri-State retains a valuable asset: 6,000 miles of high-voltage transmission lines. The company was created by its member cooperatives in 1952, to transmit power from federal dams to member co-ops. Only much later did the company make massive investments in coal-fired plants.

While it appears Tri-State’s coal plants will gradually be retired, its transmission grid remains important in delivering wind-generated power from the Great Plains… and hydropower from the Western Area Power Administration and its large dams in the western United States.