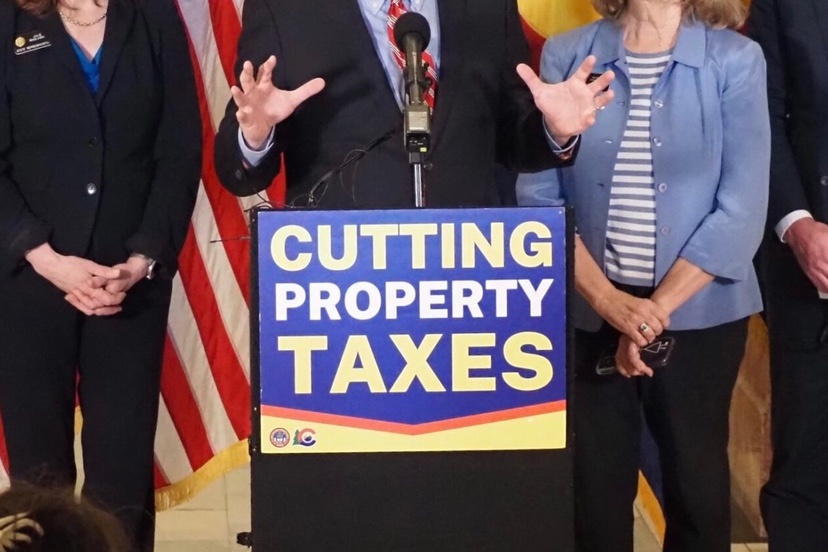

Photo: Colorado Gov. Jared Polis speaks during a news conference about a bipartisan property tax reduction bill on May 6, 2024, at the Colorado Capitol. (Quentin Young/Colorado Newsline)

This op-ed by Quentin Young appeared on Colorado Newsline on May 17, 2024.

There are smart ways to figure out tax policy, and there are dumb ways. Colorado seems to be trying to find the worst way.

Several factors in recent years resulted in spiking property taxes. It’s a problem that lawmakers across the political spectrum agree needs a fix. In fact, lawmakers at the state Capitol last week even passed a bipartisan solution.

But that solution’s longevity is in doubt, since a pair of corporate-backed ballot initiatives might lure voters to override it in November. The clash between lawmaking at the Capitol and lawmaking at the polls has marked several recent policy battles in the state, and, at least when it comes to taxes, it’s hard to see how this style of doing public business best serves Coloradans.

Property owners in the state have been vulnerable to tax increases with rising home values. State lawmakers responded with a bill that proposed a revenue cap and an assessment rate cut, and the governor signed the bill this week.

But, as a bipartisan group of lawmakers worked on the measure, conservative meddlers schemed in the shadows. The deep-pocketed groups Advance Colorado and Colorado Concern came up with two ballot initiatives that propose a severe cap on property tax revenues and a bluntforce cut of assessment rates.

Both approaches offer a cap and a cut. But the Legislature offered provisions that try to address Coloradans’ concerns while ensuring that the local services they expect are maintained. Conversely, the initiatives, 50 and 108, threaten education, fire protection and other local services, as well as the state’s general fund.

“For the deeply ideological conservative orgs running this measure, that’s just fine,” Scott Wasserman, president of the left-leaning Bell Policy Center, wrote on X about 108. “Their goal is, and has always been, to shrink government enough to drown in the bathtub. For everyone else, it should be an alarming and unacceptable threat to the stability of our State.”

Lawmakers did meet some of the demands from the initiative authors, hoping they’d back off. But on Tuesday, Advance Colorado President Michael Fields announced that his group was moving ahead with the initiatives anyway.

Conservatives such as Fields have turned the Colorado initiative process into a sort of fourth branch of state government. For example, Colorado Concern manipulated the whole Capitol by threatening to pursue a punishing property tax ballot initiative in 2022. Advance-Concern got much of what they wanted this year — commercial property tax rates will go down by about 3 percentage points under the Legislature’s plan — but in the end, lawmakers hewed to reason. Are conservative groups really prepared to go scorched earth over not getting more?

“I think what’s interesting about 50 and 108 is like, did the strategy go wrong? In other words, do they really plan to run these horrible measures that, objectively speaking, will destroy funding at the state level and local governance? Or was this a threat that just went awry?” Wasserman said.

He likens the Advance-Concern aggression to the Cuban missile crisis and sees it as a “cautionary tale.”

“For me this is not about policy anymore,” he said. “It’s about pride and ego. And so when you try to run a game of chicken like this, there’s a danger that it won’t work.”

The kind of direct democracy that the ballot initiative process provides can be crucial for ensuring the people’s will is respected. But that’s not what’s happening here. Advance Colorado is a “dark money” nonprofit whose financial backers are unknown. Colorado Concern represents business elites. As they push a superficially populist tax cut that would benefit corporate allies at the expense of neighborhoods, their posturing as defenders of “citizens” seems phony, and their methods appear to abuse the ballot initiative process.

Voters in November might be the ultimate arbiters of the state’s property tax future, but the initiatives will make sense only if voters understand the cynical path by which they got to the ballot.