At the conclusion of the joint meeting on May 6, between the Archuleta Board of County Commissioners (BOCC) and representatives of the Pagosa Lakes Property Owners Association (PLPOA), I asked BOCC chair Veronica Medina if I might address the two boards, and she invited me to step up to the podium, where a number of concerned taxpayers had spoken a bit earlier in the evening.

I briefly summarized my thoughts, about substandard roads in our community, in Part Six of this week’s editorial series.

“Working Together, if Possible, Part Six.”

My comments to the joint meeting on May 6 had touched on two ideas. First, that the Archuleta County government will never have enough tax money to address our failing roads in a satisfactory manner, especially if they continue to build multi-million-dollar government buildings, as they seem intent on doing.

Secondly, a number of neighborhoods in Archuleta County have maintained relatively satisfactory roads, using locally-governed, tax-supported districts known as “metropolitan districts” or “metro districts”. The subdivisions with metro districts include Aspen Springs, Loma Linda, Timber Ridge, Alpha Rock Ridge, Piedra Park, and San Juan River Village. These subdivisions have, in general, some of the best-maintained roads in the community. Their additional mill levies vary from about 7 mills to 15 mills.

I know of no reason why PLPOA neighborhoods couldn’t form metro districts and have similarly acceptable neighborhood roads. We all know the old adage: “You get what you pay for.” That’s not always true, if we’re talking about government bureaucracies, but it’s still a good rule of thumb.

Many folks living in Pagosa Lakes may have the impression that — if we can simply elect the right people to the BOCC — the County can eventually solve our road maintenance problems without increasing our tax burden.

15 years ago, I interviewed the County Public Works Director, hoping to learn more about our road maintenance issues, and he told me that the County was spending (then) about $6 million dollars a year maintaining its roads. To help raise that money, the BOCC had borrowed $5 million by mortgaging the old courthouse.

But we had a problem, he said, because the County had an estimated $42 million in deferred road maintenance, and we were falling further and further behind with each passing year.

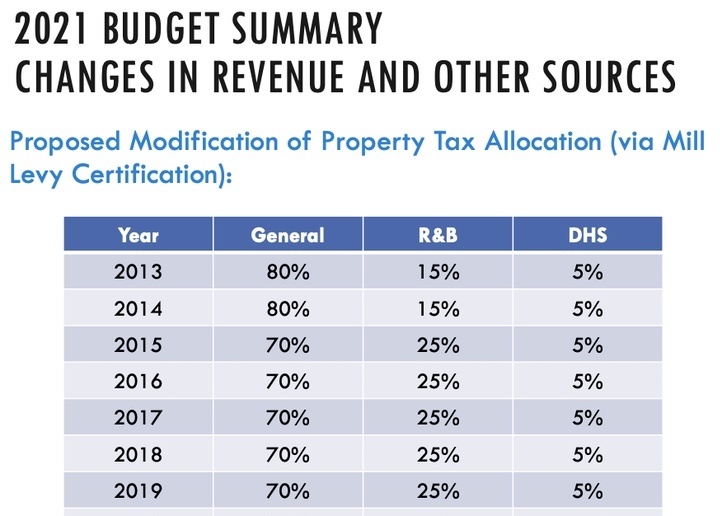

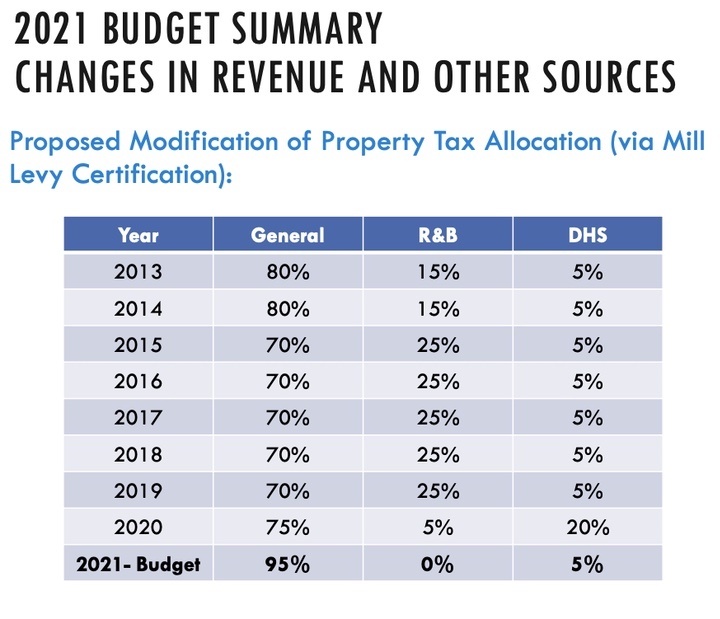

The BOCC gradually acknowledged this problem, and increased the allocation to Road & Bridge (R&B) from 15% of the property tax revenues, to 25%.

Revising the allocation meant less money going into the General Fund.

But in 2017, the BOCC decided to build a ‘state-of-the-art’ 54-bed county jail, and asked the voters for a sales tax increase to fund it. The voters said, “No. thanks.” The BOCC went back to the voters in 2018, with the same request — thinking that maybe they hadn’t properly made their case the first time around — and the voters again said, “No.”

So the BOCC borrowed the money to build the jail. (A violation, in my opinion, of the TABOR amendment, but Colorado courts don’t always agree with my opinion.). In essence, the BOCC decided to spend property taxes they had previously allocated to Road & Bridge.

So, in 2020, the allocation to R&B from property taxes dropped to 5%.

And in 2021, it dropped to 0%. Zero. Zip. Nada.

This change had very little effect on the neighborhoods that had formed metro districts, because they were not dependent upon the County for road maintenance.

But it hit Pagosa Lakes pretty hard.

If we had $42 million in deferred road maintenance in 2009… how much do we have now? $80 million?

One of the people who had heard my comments on May 6 went home and gave my comments some thoughtful consideration. He did some calculations and determined that, if Pagosa Lakes as a whole formed a metro district and burdened themselves with an additional 13 mill tax rate, the metro district would raise maybe $2.5 million per year.

I haven’t checked those calculations. But Aspen Springs maintains all of its neighborhood roads for about $280,000 per year. Of course, Aspen Springs has gravel roads, which are much less costly than paved roads, over the long haul.

At the May 6 meeting, the audience offered a suggestion to the BOCC. Since our property taxes have increased 50% to 100%, how about some improved road maintenance? Unfortunately, Archuleta County is limited by the TABOR Amendment from increasing its property tax revenues more than about 5% per year. The lion’s share portion of our property tax increase in 2023 went to the Colorado Department of Education and to the Pagosa fire district.

I responded to the person who had sent his calculations, reminding him that if PLPOA neighborhoods taxed themselves for their local neighborhood roads — as other local subdivisions are doing — then the County could focus its limited R&B revenues on the major arterial roads: Piedra Road, North Pagosa, South Pagosa, Trujillo Road… the really expensive roads that we all use.

He wrote back, after having spoken to a friend who lives in Aspen Springs. She had the impression that Aspen Springs roads had always been superior.

I wasn’t here in 1969, when Aspen Springs was platted, but the story I’ve heard is that the original developers put in absolutely horrible roads. (And of course, no utilities to speak of.). This was the last of the Wild West subdivisions in Colorado, where you needed four-wheel-drive year round. The subdivision residents eventually got fed up with the bad roads, and formed their metro district in 1987.

But… if we can’t trust the well-paid BOCC to make good financial decisions… why would we think a metro district would do any better?

Would a ‘neighborhood government’ be plagued by the same poor decision-making?