This story by Allen Best appeared on BigPivots.com on April 4, 2024. We are sharing it in two parts.

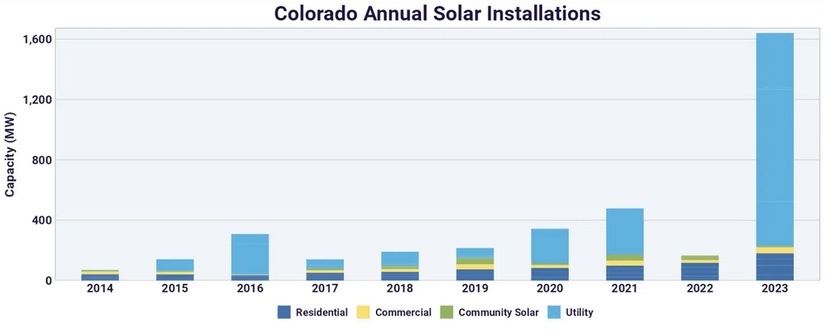

First, a question for you: What is your first reaction to seeing the chart below. Is it wow! Or had you already realized that this was coming, this break-out year for solar in Colorado?

When I talked with Mike Kruger, who directs Colorado Solar and Storage Association, he assured me that most readers of Big Pivots will not be surprised. Most saw it coming – and, in fact, had it not been for COVID and the supply disruptions, Colorado might have had its big leap during 2021.

The chart comes from the Solar Energy Industries Association report of March 2024. The report — which brims with interesting data — says nearly 40% of Colorado’s 4,112 megawatts of installed solar capacity was installed in 2023. And that Colorado is projected to gain another 2,835 megawatts of capacity in the next five years.

A full admission: I said wow, and I had been tracking this story since roughly 2016 – which is one place where this story starts. Xcel Energy that year began its electric resource planning cycle. It got bids late in 2017 and announced them just after Christmas. I remember seeing the e-mail distributed by Leslie Glustrom, an Xcel shareholder and watchdog. Wind, especially, but solar, too, had delivered jaw-dropping offers. In that instant it became apparent to me that coal would soon to be in our rear-view mirror.

The Colorado Public Utilities Commission approved Xcel’s plans for a deep investment in renewables in September 2018.

That November Jared Polis was elected Colorado governor after having campaigned on a platform of 100% renewables.

In early December, Xcel Energy announced it planned to achieve an 80% reduction in carbon emissions by 2030 as compared to 2005 levels. Platte River Power Authority announced an even more ambitious goal in December but one festooned with conditions. And by the next May, Colorado had a law that required Xcel and Black Hills Energy to attain 80% decarbonization by 2030.

Kruger had arrived in the midst of this sudden pivot to take the reins of what was then called the Colorado Solar Energy Industries Association. At the time, the staff consisted of Kruger and one other individual. The organization now has six staff members, suggestive of the growth of the solar industry in Colorado.

On a recent Friday, between an emergency discussion about legislative affairs and his next appointment, Kruger talked with Big Pivots for about 25 minutes about the context for this graph and the story that lies beyond.

Big Pivots: What explains this big jump in solar during 2023 in Colorado?

Mike Kruger: We’re finally seeing the fruits of some of our labors here to decarbonize stuff. The big jump is explained largely by Thunder Wolf and Neptune, Xcel’s two big solar projects in Pueblo County. Nearly 500 MWs of new solar and 125 megawatts of battery as well. All are for Xcel Energy. And then we have the projects of the electrical cooperatives, including the 80-megawatt project out by Bennett (east of Denver). Hunter. That power goes to CORE Electric Cooperative and …

Holy Cross Energy.

Yeah. The Hunter project came on in 2023. Multiple other smaller projects entered service in 2023, too.

We’re just seeing the fruits of the labor by COSSA and other advocacy groups to decarbonize. Neptune and Thunder Wolf were a result of the solicitation in 2017 that came online in 2023. So it takes time to build these things. Obviously, we have a pandemic between them, which pushed the timeline even further.

Now that they’ve been set up, these dominoes are going to start falling. We’re going to really see hundreds, if not thousands, of megawatts of solar added to the grid every year through the rest of the decade.

In 2019, when we passed our first decarbonization bill, we had a 15-gigawatt system in Colorado. That was our peak demand. 80% of that is around 12 gigawatts of demand. Through 2019, we had installed about 2 gigawatts of renewables, mostly wind.

So, to meet those decarbonization goals, you have to build a lot of solar farms. You have to put up a lot of wind turbines. For the first time we’re seeing that legislative and policy work finally coming together.

We can only expect it to get bigger. The future now is 25 gigawatts by 2034, according to modeling by the Colorado Energy Office. To hit that we now have to add a gigawatt (of generation) every year for all the 2020s and then need to add two gigawatts a year for the first five years of the 2030s.

It’s a good time to be a solar installer, to be a solar developer. There’s a “gignormous” market in Colorado. It’s heavily competitive, but it‘s a big market.

Mike Kruger, right, and Will Toor, director of the Colorado Energy Office, after a panel discussion about net-metering at the Colorado Solar and Storage Association annual conference in February.

How deeply is this understood within your industry. And how well do you think the general public understands this?

I suspect the world’s energy geeks recognize where solar is and where it’s going to be. I don’t think they would be surprised. In fact, I think most would be frustrated that the jump didn’t happen in 2021 rather than in 2023.

And I don’t think any Big Pivots readers would be surprised. They might be surprised by the size of the jump, but we are starting from a pretty small base.

As for people writ large, they have no idea that renewables were responsible last year for 30% of Colorado’s electric grid. I think most people would be shocked. If you were an Xcel customer, it was even higher, I think close to 50%.

And you didn’t experience outages, or at least any more outrages than you have experienced previously. You lost power for four hours in 2023, like you did in 2022, like you did in 2021, right? That speaks to how well the utilities are quickly figuring this stuff out. Kudos to them. They have one job, keep the lights on, and they’re doing it with now a much higher carbon-free mix and more intermittent generation.

OK, what we see here was basically an outcome of decisions made in 2017. If memory serves me, for much of that decade prices for solar had come down 10% a year. Although I think the costs have now leveled off.

Some of the best prices we had were in that Xcel RFP from 2017. The prices are up now. They’ve elevated, but they’re still tons cheaper than the alternatives. Go back to Xcel Energy’s most recent 120-day report. Even solar-plus-storage came in cheaper than gas. Nobody bid coal, but solar would come in cheaper than coal, even from the existing coal plants.

Is it as cheap as it ever was? No. But it’s still really cheap. And I think that whether you’re a homeowner or a utility — and increasingly we’re seeing corporate buyers, such as Amazon and Google — it’s a very viable option.

That’s combined with really strong (state) policy support. Our neighbors to the west gutted their efforts on solar support and generally climate friendly policies. And now they don’t have anywhere near the decarbonized electricity system that we do.

The neighbors to the west being Utah?

Yes, specifically Utah. They have one big city, like we do. No offense to our good folks in Colorado Springs and Pueblo. And they have similar geography: lots of mountains and high desert.

Hunter solar project, Colorado

Hunter Solar, located east of Denver and south of Bennett, came online in late 2023. CORE Electrical Cooperative has 45 megawatts of the generating capacity and Holy Cross Energy has 30.

So your members are not surprised by this. They knew it was coming. They might’ve wished that it had happened earlier, if not for Covid. Is that surge then reflected in your organization? By that, I mean the number of members you have. And I’ve been noticing that you have added staff.

It’s a “virtuous cycle.” When I started, it was me and one other individual, and we had, I think it was, 83 to 85 members. We didn’t exactly know how many we had. This week we crossed 300 members. Now, we’re at almost four times the size. And I’ve gone from me and a single individual to now me and five others. We have six on our staff.

My membership has invested in me and the organization, and we have won a bunch of policy victories, which then opens the market even further. And then that allows those folks to invest further in the policy and advocacy work that we do.

We are getting pretty close to the top. An annual survey of companies doing work in each market shows about 350 in Colorado, and I have 300 of them. Using the kind-of-standard 80-20 rule. I think we’re probably pretty close to the top as far as membership numbers go.

That doesn’t mean those members won’t continue to grow. Part of the point of our work is to ensure that members who are currently doing two rooftop systems a week can, if their customer demand is there, expand to five a week.

Or consider Sandbox Solar in Fort Collins, which started in 2015. They were exclusively a rooftop company. All they did was residential rooftop. Now they’ve expanded into the commercial-industrial market and can be successful with multiple footprints. They’re a different company now than when they started…