As mentioned in Part Two, the top income tax rate in 2023 — for the wealthiest Americans — was 37%. That’s the highest rate of the seven IRS tax brackets.

Quite a difference from, say, 1942. That year, the IRS listed 24 different tax brackets, owing between 0% and 88% of their net income. In 1950, the wealthiest Americans paid a 91% rate, and that top rate remained the same until 1964, when it dropped to 77%

We might note that the federal debt, in 1964, was $312 billion. Basically, the economy was running like a well-oiled machine, except for pockets of extreme poverty here and there.

The first big drop in the top tax rate took place under the Reagan administration, in 1982, falling to 50% for the wealthiest families. That’s about the time the federal debt hit $1.1 trillion. Then, under the George HW Bush administration, the top rate fell to 28%. These were excellent times for wealthy taxpayers.

The rate bumped back up to 39.6% during the Clinton administration, and remained there until Donald Trump took office.

Through all these ups and downs, the US economy was on a roller coaster ride that did not correlate with how much the wealthiest Americans were paying in income taxes, nor with how much corporations paid in taxes on their profits. Which is to say, you can’t predict what our economy will do, based on any particular tax rate.

Nor can you predict how much additional debt the federal government will saddle us with, based on any particular tax rate. But saddle us, they will.

Other changes have been taking place. Our public education industry, for example, determined a few decades ago that every child ought to have the opportunity to get a college education following high school. It was an easy thing to show, statistically, that college graduates earned higher incomes than non-college graduates. So if we wanted a more affluent society, it made a certain kind of sense to try and get as many people into college as possible. Plus, it kept young people out of the workforce, which lowered the nation’s unemployment rate.

This determination by the education industry had three significant effects.

1. High schools stopped offering classes aimed at non-academic careers, like wood shop, metal shop, auto shop, ROTC, home economics, business, typing…

2. Young Americans ended up heavily saddled with student debt, delaying marriages and the start of families, and hindering their entry into the starter-home market.

3. The average age of people working in agriculture, manufacturing, and the various trades gradually approached 50 years… or older… because fewer young people were entering those productive industries.

No human social patterns are simple to explain, but these three effects have played into our current situation, where one of the most coveted careers among young people is “social media influencer”.

From Indeed.com:

The national average salary for an influencer is $52,035 per year. This may depend on the size of the influencer’s presence, how many brands they partner with, and the success of their sponsored or advertised content. Influencers may be able to earn more if they grow their following or collaborate with a popular brand.

Perhaps that is the average salary. There are influencers who earn more.

Soccer superstar Cristiano Ronaldo has about 500 million social media followers, and earns an estimated $3 million each time he posts his appreciation for a product from companies like Nike, Herbalife, DAZN, American Tourister, TAG Heuer, Louis Vuitton, and Jacob & Co.

Kylie Jenner reportedly has about 400 million followers and earns an estimated $1.8 million per product posting. She has popularized brands with younger audiences, like Kylie Cosmetics, Puma, Adidas, Calvin Klein, Skims, and Pacsun.

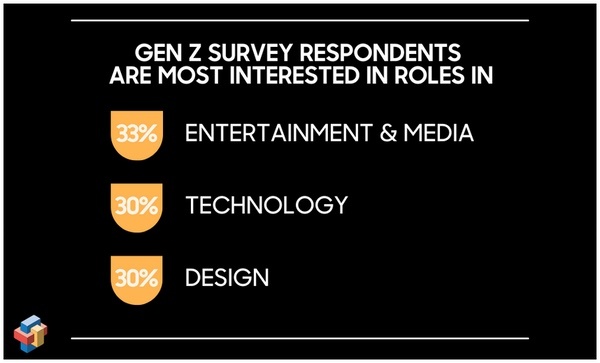

The job of “influencer” fits well into the survey results obtained in 2022 by Samsung and Morning Consult. Gen Z — the generation born between 1997 and 2010 — will soon comprise 30% of the American workforce. But they are not looking to work as secretaries, carpenters, police officers, nurses, electricians, or school teachers.

They’ve got a different view of ‘the ideal job’, and most of it involves manipulating information on a computer, or performing in front of a camera. Preferably, as their own boss, according to Morning Consult.

My own generation — Baby Boomers — might be dismissive of these priorities, which have so little connection to the basic needs of a human being: water, food, shelter, clothing, safety and security, human companionship.

Apparently, we have raised a generation that sees these basic needs as being provided by someone else, and thus wants to help provide the ‘frills’ of human existence: entertainment, well-designed web pages, and the computer code that will guide the robots and machines that seem willing to provide the basic necessities and the actual day-to-day work.

We’re sharing a brief article this morning about Colorado Senator John Hickenlooper’s support for the bipartisan Youth Apprenticeship Advancement Act to expand and advance youth apprenticeships by creating a competitive federal grant to support training programs for apprentices ages 16-22. In his opening remarks, he stated…

“Apprenticeships were once a staple of America’s workforce training, but in many communities, they’ve become more of a well-kept secret…

“What is not a secret is that employers are looking for qualified candidates to fill their talent pipelines, and relying on college talent alone is not going to do the job. Not every student can, or wants to, attend a four your — or two year — college. The reality is, 52% of the people who recently graduated didn’t complete — even if they attended college — they didn’t complete college.

“How can we make sure that our workplace solutions are meeting these student where they are, and ensuring they have the skills they need to succeed? Apprenticeships — especially for those who start while in high school — are a strong pathway to create a career. And they are a great way for businesses to form sustainable workforce pipelines…”

Competitive federal grants… to support apprenticeship programs in high schools… as an alternative to academic scholarship? For the 52% of high school graduates who will not earn a college degree?

Sounds pretty sensible to me, if America wants a functioning economy that produces more than TikTok videos.

How to pay for it?

Higher taxes on the wealthy, would be one possible choice. Reducing the amount spent at the US Department of Defense — currently $1 trillion a year — is another possible choice.