Photo: The February 16 meeting of the San Juan Headwaters Forest Health Partnership.

Some analysts have suggested that the apparent increase in catastrophic wildfires over the past couple of decades is largely the result of forestry practices that ignored a natural and healthy relationship between forests and wildfire, and purposely extinguished every little forest fire. These practices allowed our forests to become overloaded with flammable materials.

Other analyses point to a warming climate.

Still other analyses refers to an increase in the human population living in ever-closer proximity to flammable landscapes.

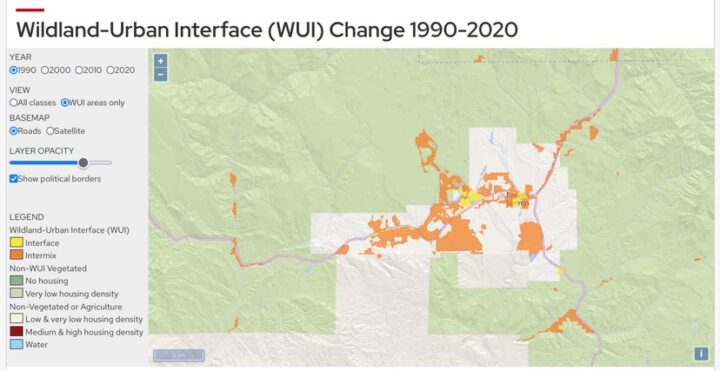

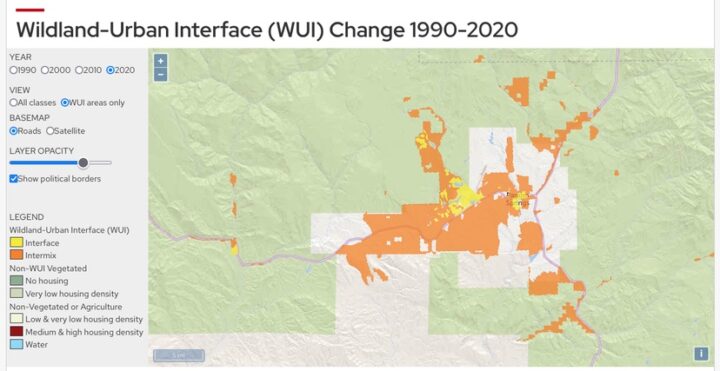

Here are two maps of the Pagosa Springs area, showing the WUI — the Wildland Urban Interface — in Archuleta County. The areas in yellow and orange indicate areas where a wildfire could threaten homes and businesses. (Maps courtesy University of Wisconsin.)

This one is for 1990:

This one is for 2020:

A bit of growth? Double the number of homes threatened by wildfire? More insurance claims, potentially?

In Part One, I mentioned some information shared at the February 16 meeting of the San Juan Headwaters Forest Health Partnership (SJHFHP) by local engineer Matt Ford, concerning the rising cost of homeowners insurance in Colorado. Mr. Ford quoted from a 2023 report by the Colorado Division of Insurance.

Today, we’ll hear more of that discussion.

I also mentioned, at the end of Part One, that I was paying $630 per year for my homeowners insurance, back in 2010. Last year, I paid $2,702, for the same coverage. At least, I think it’s the same coverage?

Mr. Ford had mentioned a new bureaucratic association currently forming itself — the Fair Access to Insurance Requirements (FAIR) Plan board and association staff. The FAIR Plan was created last year by the Colorado legislature to address situations where insurance companies may refuse coverage due to high-risk factors, such as the property’s location or vulnerability to certain perils such as wildfires. It ensures homeowners and businesses in Colorado have access to insurance even in areas prone to natural disasters or other risks.

But the FAIR Plan is not designed to help people who have insurance, but are simply paying an exorbitant rate.

Mr. Ford:

“This will not bring your cost down. It’s not for that. It’s ‘insurance of last resort’ if you cannot get any insurance.”

He also mentioned a ‘comparison chart’ published by the Division of Insurance, which you can access here. At the bottom of the page, you can create a document for various types of residential insurance. Pagosa Springs is not listed as an option, but you can do a search for Durango.

He directed his next comment toward Archuleta County Commissioner Veronica Medina, also seated at the table.

“And then for Veronica and the County, I though this was interesting…

“The State is obviously saying, ‘We’re not going to be able to cover all of this’, so the Division of Insurance is looking for — my words — helping to offset losses for insurance companies. So they have a request for proposals out right now, looking for an ‘idea’ — not a ‘project’ — but an ‘idea’ whereby they would have ‘parametric insurance’ available…”

Note, please, that Mr. Ford is talking here about “losses for insurance companies”… not “losses for homeowners”.

From Wikipedia:

Parametric insurance (also called index-based insurance) is a non-traditional insurance product that offers pre-specified payouts based upon a trigger event. Trigger events depend on the nature of the parametric policy, and can include environmental triggers such as wind speed and rainfall measurements, business-related triggers such as foot traffic, and more.

Parametric insurance policies have most frequently been implemented in developing economies, oftentimes for agriculture insurance. In the US, there are proposals to implement parametric policies more often, specifically in the case of flood insurance through the National Flood Insurance Program.

I’ve often suggested that Pagosa Springs closely resembles a ‘Third World County’… in terms of having a large, poorly paid workforce serving wealthier visitors and second-home owners. But I doubt the Division of Insurance views us through that lens.

The main benefit of parametric insurance policies is that they offer faster payouts than traditional insurance based on the nature of the trigger event, because the payment is not based on an insurance adjuster’s assessment of damage, but rather, is based on a pre-specified formula.

Mr. Ford:

“In this scenario, the policy-holder would be a state, county or municipality. The state, county or municipality would utilize the claim from the payment of the policy to reimburse the losses of the insurance provider — not to offset the losses of the insured parties… It’s an interesting idea, because I think it might actually allow communities who have difficulties getting insurance, to help insure their property owners. But if you look through this, it is pretty blatantly saying, ‘Why are the Eastern Plains paying the same increases as the mountain resort communities?’

“So by breaking it down into county or municipality or census tract, what they are doing is they’re trying to find a way to incentivize those in treed and populated areas that have a high risk, to take on additional cost…

“So all of this is coming our way in the very near future… I think it’s fair to say, we’re all going to be paying more.”

But as we may have noticed, we’re all already paying more.

Commissioner Veronica Medina:

“So I can add on to that…

“I was in Washington DC last week. I just got back. I was able to go to the Capitol and talk to legislators, senators, and we actually talked about the insurance issue…”