Photo courtesy Buckeroos Horse-Drawn Rides.

Housing is an investment. Investment prices must go up. Housing is shelter. When the price of shelter rises, people experience distress. But still, we expect our housing market to serve both purposes. This is the housing trap. We must escape.

That’s a quote from an email I received yesterday from StrongTowns.org. We’re sharing an op-ed from them, today.

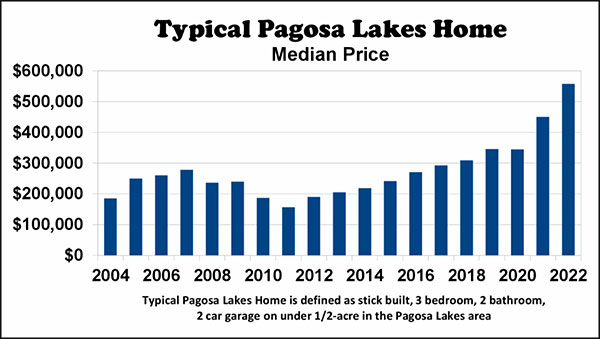

I suspect the most important thing that happened in Pagosa Springs in 2023 — that is to say, the thing most local property owners had serious concerns about — was the average 40% increase in Archuleta County property taxes, caused by the raising price of homes.

Prices, for most things, don’t typically increase by 40% in a single year. Typically. Unless you’re living in Argentina, where inflation is currently running at about 160% per year. Or God forbid, in Venezuela, where inflation is currently 283% per year.

Here in Colorado, most urban and mountain communities saw similar property tax increases, with Douglas County leading the way with an average 47% tax increase.

The Colorado legislature tried to get voter approval for a complicated tax measure last November — Proposition HH — that would have reduced property taxes slightly, but also might have eliminated TABOR refunds over the long run. The voters rejected that trade-off.

Following that failure, Governor Polis called a special session and the General Assembly approved a temporary property tax reduction similar to what was in Prop HH, but without affecting TABOR refunds.

We will paying our 2023 property taxes — due in 2024 — based on this new legislation.

But the General Assembly might have other tax ideas when they begin the 2024 legislative session next Wednesday.

Yesterday, we shared an op-ed by Summit County businessman Steven Frumess about the vacation rental business… Short-Term Rentals… STRs. Specifically, Mr. Frumess is concerned about Bill 6, a piece of draft legislation developed by the Colorado Legislative Oversight Committee Concerning Tax Policy last October.

Bill 6, as drafted back in October, would define STRs as commercial lodging, when they are short-term-rented more than 90 days per year.

As many Daily Post readers are no doubt aware, residential property is taxed differently in Colorado from non-residential property. For the 2023 tax year, a residential home is taxed at a 6.7% rate. If your residential home and land are valued at $400,000, for example, you will be paying tax based on $400,000 x .067 = $26,800.

If you live in downtown Pagosa Springs, your 2023 tax bill might be $26,800 x 64 Mills = $1,700. If you live in Aspen Springs, your property tax bill might be $26,800 x 74 Mills = $1,980.

This is for a residential home.

If you own a motel valued at $400,000 however, your assessment rate for 2023 is 27.9%. So your property will be assessed based on $400,000 x .279 = $112,000. In downtown Pagosa, your motel will owe $112,000 x 64 Mills = $7,168… about four times what a similarly valued residential property right next door will owe.

When the Short-Term Rental industry got started in Colorado, county assessors believed that STRs were residential homes, and should be taxed as residential homes. And in fact, some of the STRs were used mainly as residential homes and were rented out only occasionally. But other vacation rental homes were converted into commercial properties that were rented out for the majority of the year, or even the entire year.

In other words, if you owned a $400,000 STR in downtown Pagosa in 2023, your tax is calculated at the residential property rate — $1,700 — not at the rate paid by the commercial motel next door — $7,168.

This tax benefit has helped make ownership of STRs a profitable investment in Archuleta County. Another result is that about 1,000 formerly-residential homes have been converted into profitable commercial mini-motels. That’s about 10% of all the residential homes in Archuleta County.

I assume, as do many other people, that reducing the number of available homes in a community by 10% has had an impact on home prices for full-time residents.

In his Daily Post op-ed, Mr. Frumess asserts that taxing STRs as commercial properties will ultimately drive the larger, more valuable properties to abandon the industry, which — he believes — will seriously harm the tourism industry in mountain resort towns like his hometown, Breckenridge.

This might happen. Or it might not. Hard to predict.

As mentioned, we have perhaps 1,000 STRs operating in Archuleta County. Only about 600 of the 1,000 STRs were booked on any given night during the Christmas holidays, according to AirDNA.com. Our hotel and motels were also not fully booked. Theoretically, we could lose 400 STRs and still accommodate the same number of tourists over the winter holidays. This would be a great benefit to the remaining 600 STRs, and to the motels as well, while serving the same number of tourists.

Theoretically.

Some folks who have lived here for several decades, might agree that Pagosa Springs was already a cool place when we saw one-quarter the number of tourists we now serve.

The main question for the General Assembly, when they meet next week, is whether all commercial businesses ought to be taxes as commercial businesses, or whether certain commercial businesses should be allowed to pretend they aren’t commercial businesses. We can assume that the STR industry will be lobbying hard to defeat Bill 6, and will be making many of the same arguments made by Mr. Frumess in yesterday’s Daily Post.

I disagree with some of those arguments, looking at the world from the perspective of a journalist, and as a person who feels that our most desperate need in Pagosa Springs is to solve the housing crisis for our waitresses, clerks, garbage collectors, teachers, police officers, postal workers, nurses, firefighters…

As I’ve suggested many times to our elected leaders: we have a serious lack of workforce housing here. Not a lack of tourists.