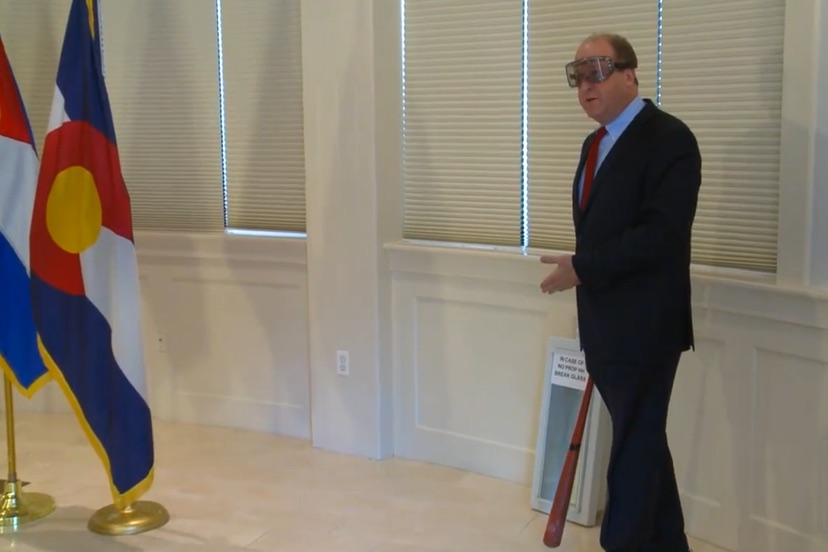

PHOTO: YouTube video screenshot of Colorado Governor Jared Polis, November 9, 2023.

Donning a pair of protective glasses, Colorado Governor Jared Polis, baseball bat in hand, stepped over to a metal box labeled: “In Case of No Prop HH, Break Glass”. Inside the box was a plan for moving forward on property tax relief, after the Democrat-sponsored Proposition HH was soundly defeated at the polls on Tuesday.

The glass didn’t appear to break, but the Governor was nevertheless able to extract a bundle of paper, suitable for the purpose of officially calling the Colorado General Assembly into a Special Session, beginning November 17.

I guess everyone wants to be a comedian lately.

Here’s a excerpt from the FOX 31 video of his Thursday press conference, edited down to 6 minutes. (The full 23-minute FOX version is available here.)

The Democrats hold the majority in both houses of the General Assembly, so it’s not clear whether they will be shooting for a bipartisan solution. The Republican minority, perhaps foreseeing the defeat of Prop HH on November 7, had called for a Special Session back in October, and had put forward a three-part proposal, for consideration, should the Governor call such an emergency session.

Which he has now called. He also called for legislators to “bridge partisan divides”.

“I am calling this session to urge the legislature to bridge partisan divides and put people over politics to provide immediate property tax relief to Coloradans facing extreme spikes from their 2023 property bills…”

Colorado homeowners have seen the taxable value of their homes increase by an average of about 40%, due to a hot real estate market during a period of low interest rates — and especially, during the recent COVID crisis, for whatever reasons.

The Colorado Education Association sent out a press release yesterday, stating in part:

In the wake of Prop HH’s defeat on the 2023 ballot, the Colorado Education Association appreciates Governor Polis’ proactive call for a Special Session to address escalating property taxes in our state. We are deeply empathetic to the challenges rising costs present to our students and their families,and the most vulnerable members of our communities, including our seniors and veterans, and acknowledge that action must be taken…

Unfortunately, the Governor’s actions were not in fact “proactive”. His actions are instead “reactive”.

The “proactive” folks in this controversy were the Republican legislators. On October 25, the Colorado Senate and House Republicans unveiled legislative solutions to address Colorado’s skyrocketing property taxes, and renewed their request for Governor Jared Polis to convene a special legislative session.

From the Colorado Senate Republicans website:

In response to this unprecedented spike in property taxes, the Colorado Senate and House Republicans unveiled common-sense solutions to deliver real property tax relief to property owners in Colorado.

The first part of the Republican solution will help provide necessary relief to Colorado seniors by allowing seniors who previously qualified for the senior homestead exemption to receive the same property tax benefit for any home they purchase and live in as their primary residence. The Republican solution would also double the current exemption amount to $200,000…

…The second part of the Republicans’ solution to lower property taxes would be to lower the assessment rates for all residential, and most nonresidential properties. The residential property assessment rate would decrease from its current 7.15% to 6.7% with the first $50,000 in value being exempted. Under the Republican solution, the nonresidential property assessment rate would be lowered to 27.9%, down from its current 29%.

As Colorado families continue to struggle with the rising cost of living in the state, the Colorado House and Senate Republicans also presented a permanent reduction in the state’s income tax from its current 4.4% to 4%.

How would such a plan affect the people of Archuleta County? If the Democrats went with the Republicans’ recommendations?

A few thoughts about taxes. Because ‘more’ is not always ‘better’… in particular, where the Archuleta County government is concerned.

The state government in Colorado has a number of revenue streams, but the largest streams are sales tax and income tax. So the Republican plan to cut income tax by 10% would have a sizable impact on the state government — highways, law enforcement, human services, economic development, parks and wildlife, water resources, and so many other service areas — but would have less impact on local governments.

Schools are funded by a mix of local property taxes and state revenues from various sources. So a reduction in state income tax could directly impact schools.

Archuleta County sends out the property tax bills in late January or early February, but most of the money collected actually goes to other government districts, notably the Archuleta School District. The numbers below are rough estimates, because we have 32 different taxing districts in Archuleta County, and they all pay slightly different mill levies, depending on which entities serve them. Some neighborhoods are served by PAWSD water, for example, and some are not.

Once te County collects the money, the School District receives about 43% of the property taxes. Archuleta County receives about 29%. Everyone in Archuleta County pays those two mill levies.

Various folks live within various service districts. Folks within the Pagosa Fire Protection District pay about 12% of their tax bill to that district. The Medical Center gets about 6% from its district taxpayers. A few areas of the community get both water and sewer services from PAWSD, and they pay about 9% to PAWSD.

You can download the Assessor’s Abstract of Assessments, here, for more details.

Your total mill levy, if you live in Archuleta County, rate varies from 39.9 mills up to 80.0 mills.

But the effect on various government districts will be different, if the General Assembly changes the state’s property tax rates.

The School District, for example, will see no noticeable difference in its total funding, because the state legislature sets the Per Pupil Revenues in May in a separate funding bill, and always backfills each school district’s local property tax funding using state revenues. We might pay more school taxes, but our local schools will not see more money from increased home values. (The recently approved Mill Levy Override extension is fixed at $1.7 million and is not affected by real estate values.)

The Pagosa Fire Protection District, meanwhile, will see a 40% increase in its revenues, when our local property tax increase by 40%. The same goes for other ‘de-Bruced’ districts like the Ruby Sisson Library and the San Juan Water Conservancy District.

But the County government is limited, by state law, to an increase of about 5%. If our local property taxes increase by 40%, Archuleta County will have to reduce its mill levy from 18 mills to about 13 mills, to stay within its legal limits.

That could be a huge problem for the County government… if local property values later begin to drop, as they did between 2009 and 2012. The County must lower its mill levy when real estate gets more expensive, but it cannot raise the mill levy later, without voter approval. Potentially, the county government can be seriously hurt, over the long term, by a sudden increase of property values… followed by a later decline.

If the state legislature doesn’t reduce our property tax rates, it could mean hard times ahead, for county governments all across the state.