PHOTO: Pagosa Springs Middle School, summer 2023.

When the survey results from 300 registered Archuleta County voters came back, from the folks at Keating Research, most of the respondents had reported that they would likely vote ‘Yes’ on a ballot issues similar to this:

The key parts of the ballot language, according to the paid consultants advising the volunteer MLO Exploration Committee, were:

1. The statement that the measure would not increase taxes, because it would merely extend the existing Mill Levy Override at the same amount that voters had approved in 2018: $1.7 million per year.

2. The statement that at least some of the money would be used for recruiting and retaining highly qualified teachers and staff, and also, for providing school safety, security, and student ‘mental health supports’.

As mentioned yesterday in Part Two, the dramatic increase in property values in Archuleta County over the past couple of years — and the dramatic increase in property taxes that will accrue to Archuleta School District (ASD) as a result, during 2024 and 2025 — will not affect the amount of overall funding available to ASD. The basic per-pupil funding for Colorado schools is defined by the legislators in Denver, and when a school district like ASD collects dramatically increased local taxes, that simply means that the state government contributes less money to the school district.

The base per pupil funding for the 2023-2024 school year was set by the Colorado legislature at $10,614, regardless of local tax collections. Last year, the state contributed slightly more than 50% of the per-pupil funding for ASD. Next year, the state will contribute an estimated 37%, with local taxes supplying the rest.

The property tax increase in Pagosa Springs didn’t make our schools richer. It made the state government richer.

Nevertheless, partly as a result of the 2018 MLO approval, the salaries at ASD have increased substantially.

According to ASD documents, here are some published salaries for 2015, 2021, and 2023.

The salary for a first-year teacher with a BA increased by almost $17,000, or by about 50%, between 2015 and 2023.

And the hourly rate paid to school bus drivers increased by about 70% over those 8 years.

Salaries also increased at our local publicly-funded charter school, Pagosa Peak Open School.

As stated, the 2018 MLO was responsible for a portion of those increases. But the special property tax override was approved with a seven-year ‘sunset’ and is due to expire in 2025. Naturally, the ASD Board of Education — being responsible for the financial health of the District — may have an interest in seeing the MLO continue.

In perpetuity, perhaps?

The ballot language that was recently tested on voters by Keating Research did not include any specific language about whether the MLO would be permanent, although the survey participants were asked if a ‘sunset’ — similar to the existing ‘sunset’ — would make them more likely to vote ‘Yes’. About 25% of the respondents reported that a sunset clause would indeed make them more likely to vote ‘Yes’.

A few voters said a sunset clause would make them less likely to vote ‘Yes’.

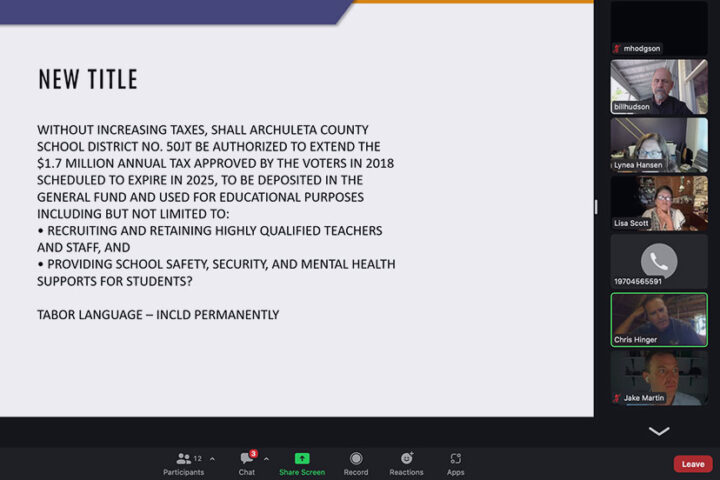

When the MLO Exploratory Committee discussed the survey results and potential ballot language at their July 17 meeting, the committee decided to recommend to the School Board a ballot measure that would specifically make the MLO permanent.

The draft letter composed by the committee, to be submitted to the School Board, includes this language:

RECOMMENDATION: It is the unanimous recommendation of the committee that the ASD School Board refer the following ballot question to the November 7, 2023 ballot:

WITHOUT INCREASING TAXES, SHALL ARCHULETA COUNTY SCHOOL DISTRICT NO. 50JT BE AUTHORIZED TO EXTEND THE $1.7 MILLION ANNUAL TAX APPROVED BY THE VOTERS IN 2018 SCHEDULED TO EXPIRE IN 2025, TO BE DEPOSITED IN THE GENERAL FUND AND USED FOR EDUCATIONAL PURPOSES INCLUDING BUT NOT LIMITED TO:

RECRUITING AND RETAINING HIGHLY QUALIFIED TEACHERS AND STAFF, AND

PROVIDING SCHOOL SAFETY, SECURITY, AND MENTAL HEALTH SUPPORT FOR STUDENTS;

WHICH REVENUE FROM THE PERMANENT EXTENSION IS FOR GENERAL FUND PURPOSES PURSUANT TO AND IN ACCORDANCE WITH SECTION 22-54-108, C.R.S.; AND SHALL THE DISTRICT BE AUTHORIZED TO COLLECT, RETAIN AND SPEND ALL REVENUES FROM SUCH TAXES AND THE EARNINGS FROM THE INVESTMENT OF SUCH REVENUES AS A VOTER APPROVED REVENUE CHANGE AND AN EXCEPTION TO THE LIMITS WHICH WOULD OTHERWISE APPLY UNDER ARTICLE X, SECTION 20 OF THE COLORADO CONSTITUTION?

When Colorado activist Douglas Bruce led the storied fight to get voters to approve TABOR in 1992, he wanted to make sure any proposed tax increase would go before voters… and that any surplus tax revenue the state collects in a given year is returned to the taxpayers, unless officials ask voters for permission to use it.

Bruce specified that tax measures on the ballot must be printed in ALL CAPS in the hopes that voters would notice that they were voting on a tax measure.

“We want to tell people the price tag upfront in capital letters,” Bruce said. “It’s not exactly grabbing them by the shoulders and shaking them, but it’s saying, ‘Hey, don’t just fool through this in some drowsy state of mind. Be aware that this is gonna cost you.’”

Here’s the recommended draft language that will be presented to the School Board, in normal language:

Without increasing taxes, shall Archuleta County School District No. 50JT be authorized to extend the $1.7 million annual tax approved by the voters in 2018 scheduled to expire in 2025, to be deposited in the general fund and used for educational purposes including but not limited to:

recruiting and retaining highly qualified teachers and staff, and

providing school safety, security, and mental health support for students;

which revenue from the permanent extension is for general fund purposes pursuant to and in accordance with section 22-54-108, CRS; and shall the District be authorized to collect, retain and spend all revenues from such taxes and the earnings from the investment of such revenues as a voter approved revenue change and an exception to the limits which would otherwise apply under Article x, Section 20 of the Colorado Constitution?

That last phrase, about “collect, retain, and spend all revenues” means that the MLO funds will not be subject to the normal TABOR limits on government spending increases.

The elected Archuleta School District Board of Education will make the final decision about putting this measure on the November ballot.