PHOTO: Tourists enjoying their stay in a Short-Term Rental.

About nine months ago, a group of taxpayers calling themselves ‘Pagosa Neighbors’ mailed out a four-page campaign newsletter urging Pagosa Springs voters to support Ballot Question A on the Town’s April 2022 ballot. That ballot question was ultimately approved, creating a $150-per-bedroom-per-month fee on the operations of Short-Term Rentals (STRs) within the town limits. The revenues must be used to address the lack of workforce housing in the community.

Only voters living within the town limits received the mailing, because only town voters were allowed to participate in the election. The 85% of the community’s population that lives in the unincorporated county were helpless spectators.

The campaign newsletter made the argument that the conversion of existing residential homes into tourist motels was helping to drive up the cost of housing for the full-time residents of Archuleta County — and, in particular, for workers who wanted to accept employment in Archuleta County but could not afford the cost of housing here.

The newsletter also made the argument that $150 per bedroom per month was a reasonable fee, because — due to inconsistencies in Colorado’s property tax laws — residential homes that have been converted into tourist motels pay only one-quarter the property tax rate paid by all other commercial businesses, including motels and b&b lodging. Thus, the commercial STRs — defined as ‘commercial’ in all other aspects — were not contributing fairly to the operations and maintenance of our schools, governments, and districts, at the same level as other commercial businesses.

The proponents of Ballot Question A had calculated the property tax differential, based on the typical sales price of different size homes — one-bedroom, two-bedroom, three-bedroom, etc. — and determined that the Short-Term Rental Tax Loophole could be addressed most fairly by a $150-per-bedroom-per-month contribution from STRs. Proponents hoped that some STR owners would find it financially advantageous to rent their properties “long-term” instead, thus helping to address the housing crisis.

As noted, this fee applies only to the approximately 150 STRs located within the town limits. Another 1,100 STRs — or maybe more — currently operate outside the town limits in the unincorporated county. (The number is uncertain, due to difficulties identifying which homes, exactly, have been converted.)

I mention this rather simple mathematical calculation — a relationship between the property tax ‘loophole’ enjoyed by STRs and the fee that town voters approved last April — because there are simple ways to calculate appropriate fees, and there are complicated ways to calculate appropriate fees.

The Town of Pagosa Springs has posted the agenda for tonight’s Tuesday, December 6, Town Council meeting. The agenda includes these items:

VI. NEW BUSINESS

1. Vacation Rentals Nexus Study Results

2. Public Hearing on 2023 Budget

3. Resolution 2022-22, Approve 2023 Budget, Set Mill Levies, Appropriate Funds and Adopt the Capital Improvement Plan

You can download a copy of the entire 548-page agenda packet on the Town website, here. ( Click the “Agenda packet” link near the top of the page. It’s a large file, and will take a while to download… and much longer to read.)

You can download the Root Policy Research report (“Vacation Rentals Nexus Study”) here (31 pages).

This editorial series is concerning itself mainly with the 31-page Root Policy report. The Town budget is also interesting if you’d like to know where $15 million of your tax money is going.

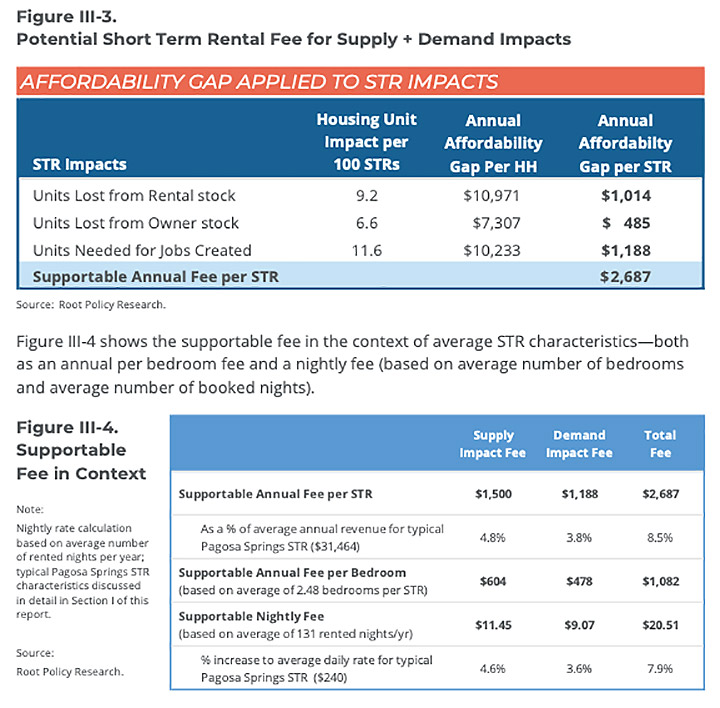

If we want to cut to the chase, and skip quickly over the first 24 pages of the “Nexus Study”, we find the following — a suggested impact fee that the Town might want to establish, at some point in the near future…

…assuming the existing ‘Workforce Housing Fee’, established by the voters last April, gets terminated by a court decision. That would be unfortunate, but it might happen.

There are a few numbers here (which get more or less explained during the first 24 pages) but the most important number might be “$2,687”. That’s the “per STR” impact fee amount Root Policy Research believes to be legally supportable, based on two different types of impacts caused by the STR industry.

The math used to calculate the Root Policy fee amount is a bit complicated:

Methodology

The main econometric specification used is:

LnHousingUnitSit

= ß LnAirbnbit + γ LnAirbnbit X OwnerOccRatei,2010 + Xit + µi + ⍬t + εit

Where LnHousingUnitSit is the natural log of different measures of housing supply in each zip code area, including: the number of rental units (occupied plus vacant for rent), the number of ownership units (occupied plus vacant for sale), the number of vacant units for rent, the number of vacant units for seasonal and recreational purposes, and the total number of housing units. LnAirbnbit is the natural log of the total number of cumulative listings in each zip code and year. The total number of Airbnb listings is also interacted with the share of total housing units that were owner occupied in 2010. Xit is a vector of zip level controls including: the natural log of population and median household income, and the employment rate of the population over 16 and the share of population over 25 with a college degree. Zip code level fixed effects µi , are included to account for differences in fixed amenities across zip codes, and time fixed effects ⍬t, to control for time varying factors that impact all zip codes equally.

Daily Post readers might find it interesting to note that STRs within the town limits have an average of around 2 bedrooms. The ‘Workforce Housing Fee’ established last April by the town voters assesses a two-bedroom STR a fee amounting to $3,600 per year. So then, somewhat more than the $2,687 amount that Root Policy found to be “supportable” when using the equation:

LnHousingUnitSit

= ß LnAirbnbit + γ LnAirbnbit X OwnerOccRatei,2010 + Xit + µi + ⍬t + εit

But the voter-approved ‘Workforce Housing Fee’ was not based on the number of lost rental units (part of the Root Policy calculation) or the number of lost owner-occupied units (also part of the Root Policy calculation) or the number of low-paying jobs created by an expanding number of tourist visits (also part of the Root Policy calculation).

The voter-approved ‘Workforce Housing Fee’ was based on a property tax loophole — the amount of property taxes not paid by commercial STR operations.

That equation would conceivably look like this:

WorkForceHousingFee = PropertyTaxLoophole x NumberOfBedrooms

I know of no other Colorado community that has used this particular equation when creating its STR impact fees. The town voters didn’t particularly care what share of the population over 25 had a college degree, or the employment rate of the population over 16. The voters were merely addressing the property tax loophole.

Obviously, Root Policy preferred their own equation.