PHOTO: North Pagosa Boulevard, one of the most traveled County roads in the Pagosa Springs community. October 2022.

No one, I think, is especially happy about the Archuleta Board of County Commissioner’s failure to properly maintain our county roads. But not everyone understands why our roads are so poorly maintained. Maybe no one does?

Some people think it’s partly because the BOCC eliminated property tax revenues from the Road & Bridge budget, and re-directed the money to help fund a multi-million-dollar spending spree on new County buildings.

A new 54-bed jail. ($19 million?)…

A new Courthouse for the Sixth Judicial District. ($7 million?)…

A new DHS building. ($3 million?)…

An expanded and remodeled Sheriff’s Office. ($1 million?)…

… with additional new facilities in the planning stages.

The County is now paying $1.5 million annually for ‘debt service’, none of it approved by the voters.

I wonder how far into debt the BOCC is willing to go?

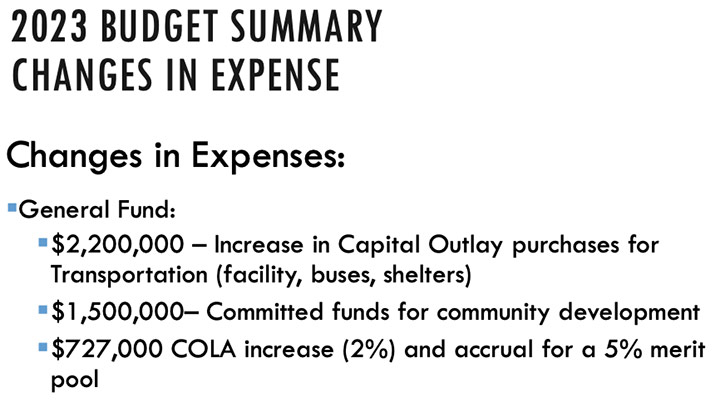

Other folks think the road maintenance funding problem might be related to significant salary increases granted to County employees. The projected increase for 2023 is $727,000.

From the 2023 County Budget Presentation:

But the BOCC seems to believe Ballot Issue 1A could be the answer to their financial ambitions. If the voters will just cooperate.

According to the Colorado Secretary of State’s election website, a government-funded organization called the Pagosa Springs Community Development Corporation has donated $16,250 dollars to an issue committee named ‘Committee for Safe Roads 1A’ in an effort to convince Archuleta County voters that a $6.5 million sales tax increase (in the first year, and lasting forever) is the best way to allow our County government to spend grandly, and still have enough money left over to properly maintain our county roads. Apparently, not a single private citizen has made a donation to this issue committee.

Meanwhile, a small group of local citizens (myself included) have chipped in out of our own pockets to fund an informational campaign, through an issue committee called ‘Fair Taxes for Archuleta’. No government money is involved. We’ve run ads in the Pagosa Springs SUN and on KWUF radio, and we’re currently printing flyers to be mailed out to a few of the more vulnerable neighborhoods.

As one of our Daily Post op-ed contributors, Rachel Suh, pointed out this week, the language on your ballot regarding the 1A tax increase appears to assure you that at least half the increase will be used to fix our roads.

Appearances can be deceiving, however.

It turns out that the BOCC can, in fact, use the money however they wish, thanks to a simple sentence inserted into the authorizing resolution, Resolution 2022-98.

23. Amendments. Unless otherwise required by Colorado law, the provisions of this Resolution may be amended by resolution of the Board of County Commissioners.

There are other ways to grow our government bigger and bigger… if that’s what we want.

There’s the $1.5 million we collect annually in Lodgers Tax, for example… most of which is spent trying to attract even more tourists to occupy even more of the residential homes in our community — the residential homes that have now been turned into vacation rentals. We’re not talking about big, luxury homes. These are the homes that retirees and working families used to live in. According to research website AirDNA.com, 60% of the STRs (Short-Term Rentals) in the 81147 zip code are two-bedroom or less. Only 4% have four or more bedrooms.

In a separate op-ed, Ms. Suh wrote about a new Colorado law that allows voters to authorize Lodgers Tax to be spent to address a wide range of community uses. The BOCC could have placed that issue on the 2022 ballot, asking us to approve those additional uses. But they didn’t.

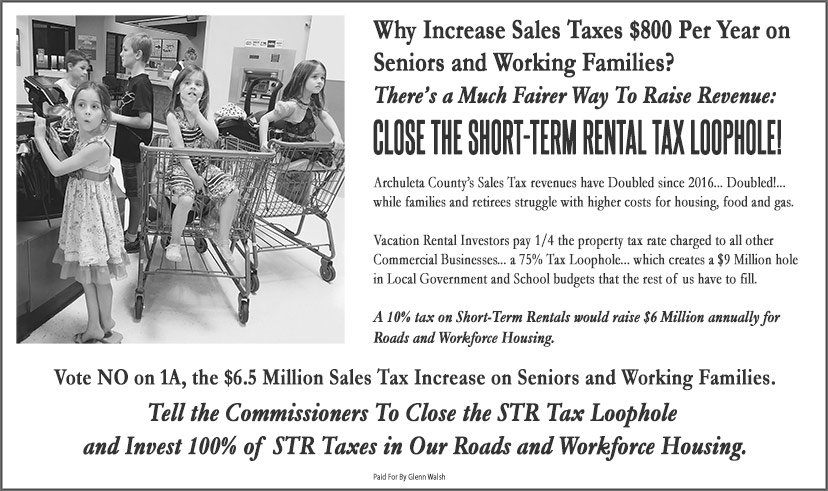

A local activist, Glenn Walsh, purchased some advertising in the weekly Pagosa Springs SUN, with yet another reasonable suggestion for addressing the real needs of the community: lack of road maintenance and a worsening housing crisis:

Mr. Walsh points out, in this advertisement, that the BOCC could conceivably raise $6 million to be used for roads and housing… with a simple 10% tax on STR stays to be paid entirely by the tourists who come here, enjoy our town and its amenities, and then leave us to pick up after them.

The justification for a 10% tax is fairly simple: STRs currently pay only 1/4 the property tax rate paid by all other commercial businesses — while removing residential housing from our community.

The Chamber of Commerce in Steamboat Springs — another mountain resort town similar to Pagosa Springs — conducted a study of the likely impacts on their STR industry, if the voters approve a new 9% tax on STRs that appears on their 2022 ballot. From an article by Dylan Anderson in the Steamboat Pilot earlier this week:

If Steamboat voters approve a proposed 9% tax on short-term rentals next month, the demand for these nightly rentals would decrease by 3.6% — or three to four room-nights per 100 — according to a study presented to the Steamboat Springs Chamber Board last week. Slides from the presentation also show that the demand for Steamboat Springs as a destination for people looking to stay in a short-term rental would decline by 2%…

Could Pagosa Springs voters tolerate a 2% drop in tourism… in exchange for a $6 million infusion of revenue aimed at housing and roads?

Obviously, Mr. Walsh believes this should have been the tax measure we found on our November ballots.

But we were not presented that option by our current BOCC. They apparently prefer to have us to dig deeper in our pockets, every time we purchase necessary items… while allowing STRs to continue benefiting from a significant tax ‘loophole’.

According to another article by Mr. Anderson in the Steamboat Pilot, the Town of Frisco approved an additional STR tax in April, with 64% of the vote. It adds a 5% excise tax on short-term rentals, bringing the tax rate on these units to 15.725%.

Silverthorne increased its lodging tax from 2% to 6% with nearly 75% of voters in support, bringing the rate for STRs to 14.375%. Avon’s 2% tax passed with about 70% support in November, bringing the tax rate there to 14.4%.

Last month, Aspen City Council approved a ballot question that would impose an additional 5% or 10% in taxes on STRs, depending on whether the unit is owner-occupied.

Sales tax? STR tax? Which would you choose?