The photo above was taken at a September 27 joint meeting of the Pagosa Springs Town Council and the Archuleta Board of Council Commissioners. Professional campaign manager Beth Lamberson was sharing images, via Zoom, related to Ballot Measure 1A, which the BOCC has placed on this November’s ballot.

The images included a rough draft of some ‘yard signs’ that might be purchased to encourage a ‘Yes’ vote on Ballot Measure 1A. The design refers to “The Safe Road Home”. Referring, of course, to those of us in Archuleta County who still have a home.

Over the next few weeks, Archuleta County voters who read the news, or listen to the radio, or receive mail, might be exposed to arguments ‘for’ and ‘against’ this proposed $6.5 million increase in the Archuleta County sales tax. Conversations might also occur on social media… but since I purposely avoid social media, I will probably miss those discussions.

Just to be clear, Ballot Measure 1A doesn’t merely ask for an additional $6.5 million. That’s only the amount estimated for 2023. The tax increase, as proposed, is perpetual, and according to the calculations from ‘Fair Taxes for Archuleta’ — an issue committee that is opposing the tax increase — the additional amount extracted from the taxpayers over the next ten years would likely be somewhere in the neighborhood of $75 to $95 million.

Let’s call it, an increase of $85 million?

The fact that the Archuleta County BOCC wants more of our money is not an ‘extraordinary change’. It’s actually ‘more of the same’. They asked for a tax increase in 2012 and were turned down. They were also turned down in 2017 and 2018.

The Town and County have been holding fairly regular joint meetings lately, with the apparent goal of getting Ballot Measure 1A approved by the voters. To entice the Town Council to support the ‘$6.5 million’ increase, the County Commissioners have promised to split the money (if it arrives) with the Town Council, 50/50.

It’s pretty obvious that certain Town Council members were intrigued by the thought of splitting $85 million in additional taxes over the next ten years. (Although three of the seven Council members ended up casting votes in opposition to the Town’s support of the ballot measure.)

Of course, the Town and County are prohibited, by Colorado law, from campaigning in favor of their own tax increase measure… so the government-supported Pagosa Springs Community Development Corporation has hired a team of professionals to run a ‘Yes on 1A’ campaign. As we shared earlier this month in a previous editorial series, the PSCDC was formed in 2010 by joint action of the Town and County. It was supposed to become an ‘independent’ non-profit corporation that would be supported and funded by the business community, with minor contributions from local government.

This was in 2010. But the PSCDC has been living off the taxpayers ever since. For 2022, the PSCDC budget shows a projected income of about $866,000. According to my reading of the budget, slightly more than $778,000 was contributed by our Town and County governments.

About $10,000 is expected to come from local business memberships this year. You can download the 2022 PSCDC budget here.

According to my pocket calculator, 90% of the funding for this ‘independent’ non-profit corporation will be contributed by local government this year. Based upon those numbers, we would be tempted to classify PSCDC, functionally, as an arm of our Town and County governments. This is the organization that will be leading, and funding, the ‘Yes on 1A’ campaign.

Usually, when you run a ‘Vote Yes’ campaign, you are careful to say certain things repeatedly, and you carefully avoid talking about certain other things that might make the voters uncomfortable. For example, if you were running a ‘Yes on 1A’ campaign, you would probably avoid mentioning the figure $6.5 million. You would definitely avoid mentioning the figure ‘$85 million’.

If you were professional, you would likely focus on the ‘positive’ aspects of a huge tax increase.

When campaign professional Beth Lamberson presented to the joint Town-County meeting this week, she did indeed avoid any mention of the amount of proposed tax increase.

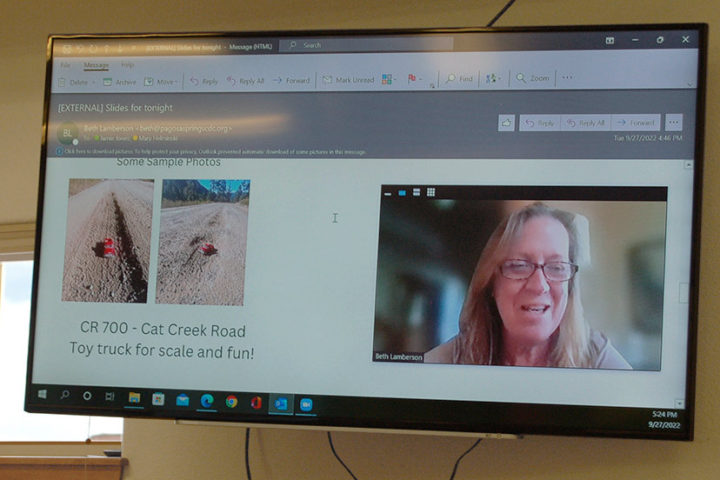

Ms. Lamberson focused instead on fun campaign ideas, like photographs of little toy trucks sitting in potholes and ruts, on County-maintained road. Or rather, on roads that the County has failed to properly maintain. Ms. Lamberson apparently wanted the gathered Town and County leaders to endorse the general direction for the campaign. Which our leaders did.

The separate resolutions approved by the Town and County specify that a portion of the potential $85 million should be spent on streets and roads. But Town Attorney Clay Buchner assured the Council members, earlier this month, that a resolution can be repealed or changed by a future Council… and the money could then be used for anything the elected leaders want to use it for. Presumably, the BOCC could do the same… use the money however they wish. Forever.

Do our local governments truly have a need for $85 million in additional money — on top of their existing, ever-increasing tax collections — over the next ten years? I’m not sure our elected leaders would even know how to spend that much money.

Over the past year, several of my colleagues and I, as well as the Town Planning Commission, were urging a very different approach to the two biggest issues in Archuleta County — namely, our deteriorating roads and our worsening housing crisis. We determined that our vacation rental industry was benefiting from a Colorado property tax loophole that allowed themto contribute — based on an unfair tax rate of 6.95% — millions of dollars less in property taxes compared to other commercial businesses in Archuleta County who pay the commercial 29% property tax rate.

The Colorado General Assembly has shown little interest in fixing this tax loophole. So we proposed, to the Town and County governments, the idea of placing a special tax on Short-Term Rentals — STRs — and allowing them to contribute to our two biggest issues, in a fair manner.

Americans generally believe in fairness.

We also suggested that a portion of the massive tax increases being spent by the Pagosa Springs Area Tourism Board to promote the tourist industry, could be used to support workforce housing.

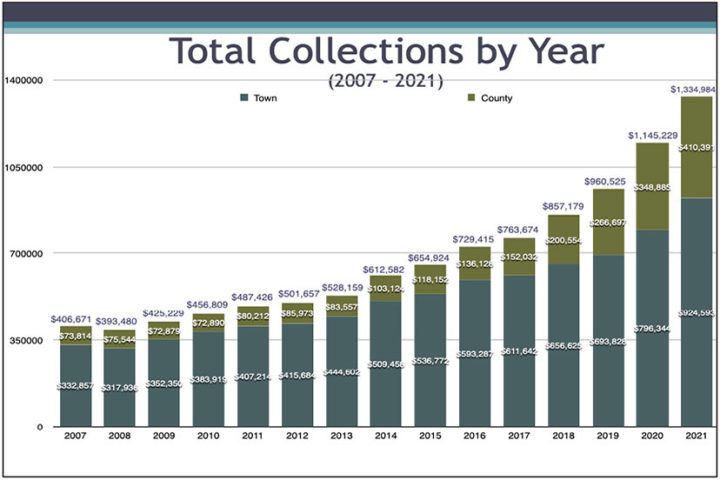

Considering that that the PSATB tax collections had more than doubled since 2015.

Our most vocal critic? County Commissioner Ronnie Maez.

Commissioner Maez, at numerous public meetings, vigorously criticized a proposed tax on STRs… and also fought the idea of using Lodgers Tax revenues to directly address the needs of local residents. (Colorado law now allows Lodgers Tax to be used in this manner.)

Commissioner Maez said he had a different solution. A sales tax increase. He argued that a sales tax would provide a more ‘reliable’ revenue stream than a tax on STRs or a re-direction of Lodgers Tax… to address, especially, our housing crisis.

Curiously enough, when Commissioner Maez approved Resolution 2022-98 — placing a proposed $6.5 million sales tax increase on the ballot — the resolution did not even mention the word ‘housing’. But it did mention other things.