Yesterday, we shared an op-ed by Charles Marohn, the founder of Strong Towns, a national organization promoting sustainable community development… something rather rare in 21st century America.

In his column yesterday, he wrote:

A year ago, someone with reasonable credit could get a 30-year mortgage at a 3% interest rate. Historically, that is unprecedented and it explains a lot of the current bubble. Today, 30-year rates are around 7%, with indications that they may go significantly higher, especially if inflation is persistent.

People purchase homes based on the monthly payment they can afford. Let’s say you are a household that can afford $1,000 a month in house payment. At a 3% interest rate, you can buy a $237,000 home. At a 7% interest rate, you can only buy a $150,000 home. That’s a 37% reduction in purchasing capacity, just from interest rate fluctuation.

Now into that calculation add broad and persistent increases in local taxes, the kind necessary to even attempt to maintain all of that failing local infrastructure our municipal governments built and are now responsible for. You know, the infrastructure that you depend on to have drinking water, fire protection, a way to get to work, and more…

We’ve had an infrastructure crisis, here in Archuleta County, for the past 25 years, especially regarding roads. During the 1970s and 1980s, the Archuleta Board of County Commissioners allowed dozens of new subdivisions to be built in the unincorporated county — outside the limits of the Town of Pagosa Springs. They honestly had no idea what they were getting us into.

Hindsight is 20/20… and in this case, hindsight reminds us that our Archuleta County government — and county governments in general — were never designed to manage vast areas of suburban development. County governments in Colorado have historically taken care of roads with led to large ranches… roads that were impacted by minimal vehicle traffic, and required relatively little maintenance.

But beginning in the 1970s, developers began approaching the County government with plans for suburban roads — roads that would be constructed by the developers themselves, and would then be handed over to the County government for maintenance. One large ranch after another was converted into dozens of quarter acre parcels, and dozens of (sometimes poorly constructed) new roads were deeded over to the taxpayers.

When the dust cleared, Archuleta County had more than 300 miles of suburban roads — about 40 miles of which was paved. Paved roads are preferred in terms of dust and durability, especially in high-traffic neighborhoods. Unfortunately, they are also the most expensive to build and maintain. A paved road generally looks great for about 15 years. Then the repair bills begin to show up.

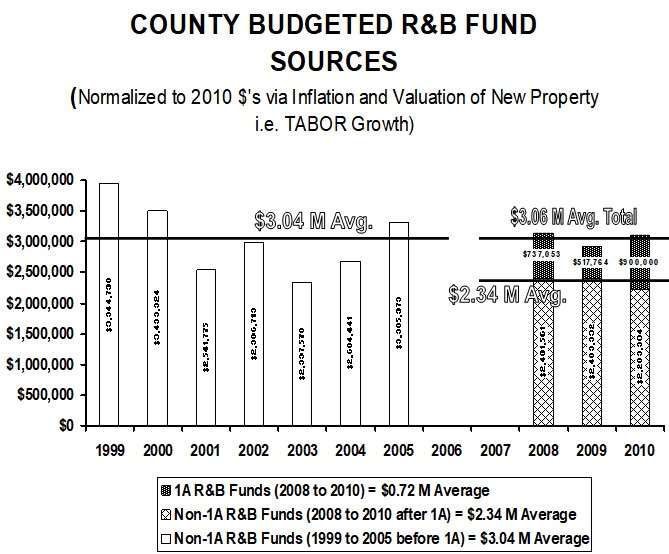

I rarely attended BOCC meeting during the 1990s, when my family was still settling in to the community in downtown Pagosa Springs, where most of the streets had been newly paved. But when I started writing for, and editing, the Pagosa Daily Post in 2004, I was quickly introduced to the County’s road issues. These issues appeared to be basically money issues, as so many issues can easily appear to be. The BOCC was working on a proposal to fix the roads, and their plan involved a tax increase called Ballot Measure 1A. I’ve previously shared a chart showing what happened to the County’s revenue after the voters approved the 1A tax increase in 2006. We paid a lot more property tax.

A lot more.

But it wasn’t enough. It wasn’t enough, for a number of reasons, including the fact that the County didn’t actually put any extra money into roads. Yes, they spent the 1A revenues on Road & Bridge, but they re-directed other money — previously dedicated to Road & Bridge — into other departments.

But it wasn’t enough. It wasn’t enough, for a number of reasons, including the fact that the County didn’t actually put any extra money into roads. Yes, they spent the 1A revenues on Road & Bridge, but they re-directed other money — previously dedicated to Road & Bridge — into other departments.

As documented by a Daily Post reader. (Normalized to 2010 dollars, to account for inflation.)

The simple fact is, Archuleta County cannot afford to maintain its own roads. We allowed too many roads to be constructed, based on the amount of property tax we collect.

Especially, we cannot afford to maintain our roads when our BOCC has committed itself, over the past decade, to a massive facilities expansion program — starting with the abandonment of existing County facilities and the construction of ‘new’.

A new jail. A new courthouse. A new dispatch center. A new Sheriff’s Office. A new DHS building.

And, in the works currently… a new bus facility, and a new Administration Building.

This expansion program has not been cheap…

To take a step back in this analysis. County governments in Colorado were designed to manage rural areas, with minimal urban demands. In most communities, businesses and dense residential development have traditionally located within the town limits, where the tax structure is designed to support urban development.

But Archuleta County decided, decades ago, that they wanted to be a suburban paradise, with lots of roads and infrastructure needs — but without the municipal revenues that typically support this level of development. Twenty years ago, the County realized their mistake and proposed a huge property tax increase called Ballot Measure 1A, promising us that they would finally get the roads fixed.

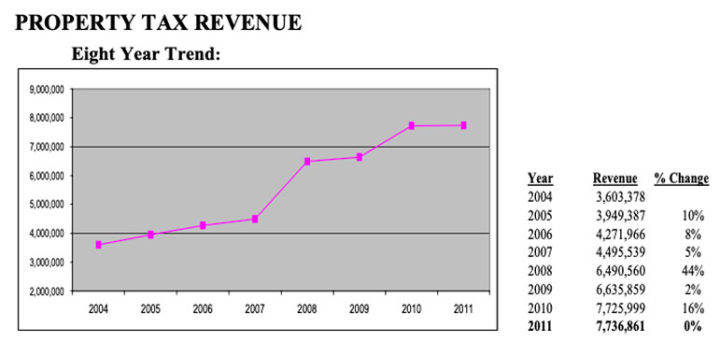

How did that work out? Well, I think most full-time residents have been unsatisfied with the level of service, in spite of a 100% increase, since 2016, in the amount we’ve paid in County sales tax. And in spite of steadily increasing property tax collections since 2012. And in spite of huge increases in County Lodgers Tax collections as well.

Some governments are simply not happy, no matter how much money you give them. So now, we have yet another ‘Ballot Question 1A’ on the ballot, to increase the County sales tax by 37.5%… and more promises to fix the roads.

I shared a quote, from Charles Marohn, earlier in this editorial. Here it is again… with a sentence that follows in his essay:

People purchase homes based on the monthly payment they can afford. Let’s say you are a household that can afford $1,000 a month in house payment. At a 3% interest rate, you can buy a $237,000 home. At a 7% interest rate, you can only buy a $150,000 home. That’s a 37% reduction in purchasing capacity, just from interest rate fluctuation.

Add an additional $50 a month in property tax—a laughable amount compared to the backlog of liabilities every city has in the ground—and that same household can no longer pay $150,000 for a home; they can only pay $143,000.

Or alternately, you can add an additional $80 a month in increased sales taxes. And now the family can’t afford even $143,000.

Seems like we keep driving down the same, poorly maintained road, no matter what we do, and no matter how much we pay.

Aren’t there some extraordinary changes we could make?