This editorial series relates mainly to a proposal, put forward by the Archuleta Board of County Commissioners (BOCC), that the community’s voters be given the chance to raise their tax burden at the upcoming November election… by $6.5 million.

Because the County’s current 4% sales tax is shared 50/50 with the Town of Pagosa Springs under an agreement approved by the voters many years ago, the BOCC invited the Town Council to participate in the decision-making process.

The most recent joint meeting, to hash through some details, was held on August 16, and began with a relatively brief overview of the community survey conducted by Louisville, Colorado-based Magellan Strategies between August 3-16.

For example. What might this $6.5 million be used for?

Should the tax increase appear on the November 2022 ballot, or should our local governments wait until a future November election?

Considering that our local governments can’t even tell us what the $6.5 million would be used for… or whether they actually might only need $1 million… perhaps waiting for a future election would be a wise move? But once a group of elected officials start talking about a tax increase, it’s hard to get them to stop.

The conversations can, however, be brief. The joint Town-County conversation on August 16 lasted approximately one hour.

To put $6.5 million into some kind of perspective:

1. The conversation on August 16 lasted 67 minutes. That comes to about $100,000 per minute of conversation.

2. There are about 14,000 people in Archuleta County, which equals about 6,000 full-time households. So a $6.5 million tax increase, paid mainly by local, full-time residents, would amount to about $1,000 per household. Some people like to claim that ‘tourists’ pay a significant portion of the sales tax in Archuleta County, but no one (to my knowledge) has ever presented scientifically valid data to support that claim. I did a calculation several years back, based on County sales tax collections, and estimated that tourists pay about 18% of the sales tax in our community.

3. An increase of 1.5% to the existing 4% sales tax amounts to a 38% increase to our local governments. As prices increase, the amount of tax we pay will increase as well.

4. Very few working families in Archuleta County have seen a 38% increase to their income over the past decade.

As reported yesterday in Part Two, the joint meeting heard from County Manager Derek Woodman that a county government is limited by Colorado law to a maximum sales tax of 4.2%. If true, that would make a 1.5% sales tax increase illegal.

At their work session yesterday, August 23, the Board of County Commissioners received some new information.

For one thing, County Attorney Todd Weaver claimed that there is, in fact, no such legal “4.2% limit” on the amount of sales tax a county government can collect.

The BOCC also heard that the budget estimates for a planned new County transportation facility came in at $800,000 more than had been expected. A smaller building might be more appropriate, we were told. Or some additional grant funds might be found, somewhere.

The commissioners also heard that the La Plata Board of County Commissioners appear to be moving ahead with dissolving the San Juan Basin Public Health district, which would mean that, under Colorado law, Archuleta County would soon need to create and fund its own county health district.

The commissioners did not sound pleased with this development.

But the first part of yesterday’s work session consisted of a presentation of the recent sales tax survey, delivered by Courtney Sievers of Magellan Strategies.

A much more comprehensive and detailed presentation than had been shared a week earlier with the Town Council.

Apparently, most of the 1,081 survey respondents had been directly invited to participate in the survey by the team at Magellan, based on phone numbers and email addresses provided by the Town and County governments. About 25% of the participants found the survey without receiving a direct invitation.

Ms. Sievers indicated that Magellan had made an effort to choose a selection of local residents that reflected the demographic groups deemed most likely to vote in the November election.

So then, these representative groups:

1. About 70% were voters over the age of 55. Only 9% of the participants were under the age of 35.

2. About 47% Republicans, 30% Unaffiliated, and 23% Democrats.

3. About 81% white, non-Hispanic, and about 13% Hispanic.

Then we heard how certain voters feel about Archuleta County, in general.

54% of the survey respondents disapproved of the job Archuleta County is doing, providing services to county residents. The groups that disapproved most strongly were people under the age of 45, and Unaffiliated voters.

41% approved of the County’s efforts. Democrats stood out as the most positive group.

But Ms. Sievers pointed out that only 4% “Strongly Approve” of the County’s job… while 23% “Strongly Disapprove”.

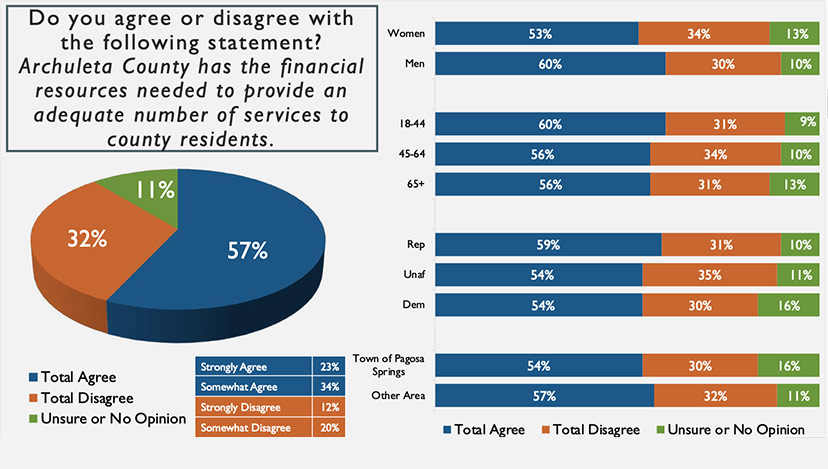

The next question. Do voters feel like Archuleta County already has enough ‘financial resources’ to do a good job?

Here we learn that, among the respondent groups, more than 50% of every group felt that Archuleta County already has adequate financial resources. The groups that felt most strongly about the adequacy were “Men”, “Republicans”, and “Ages 18-44”.

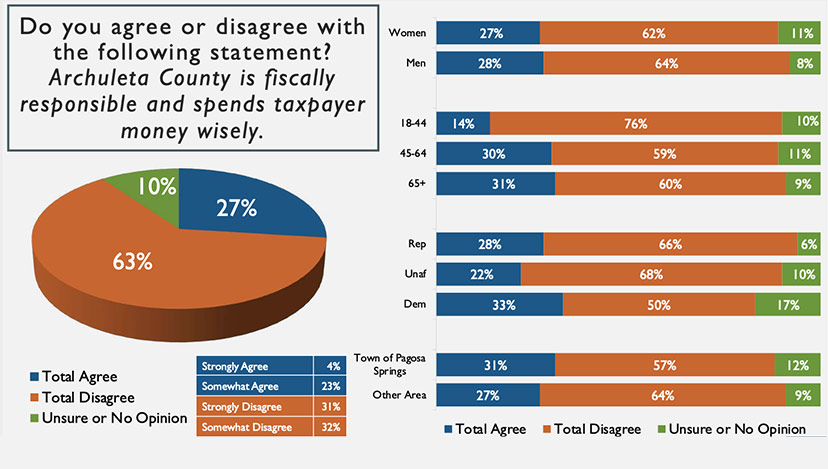

The next question. Is Archuleta County doing a good job with the money we provide?

Apparently not.

Only 4% of the respondents “Strongly Agreed” with the statement:

Archuleta County is fiscally responsible and spends taxpayer money wisely.

Every group overwhelmingly disagreed with that statement. The groups most disappointed in the County’s spending habits?

Voters age 18-44 (76%)

Unaffiliated voters (68%)

Republican voters (66%)

Residents living in the unincorporated county (64%)

Put another way: among nearly all groups, twice as many people disapprove of the County’s spending habits as approve.

The Magellan team asked the same questions about the Town government. Are they doing a good job? Do they already have enough money? Do they spend our money wisely?

In general, the community believed the Town government was doing a better job, overall, than the County was doing. Once again, we saw that twice as many respondents felt the Town already has sufficient resources, as disagreed with that proposition.

We note that all of these questions, in the survey, were asked at the beginning… before the Magellan Strategies team began delivering a sales pitch for the sales tax increase.

Maybe the sales pitch was effective?