And Jesus said unto him… Thou knowest the commandments, Do not commit adultery, Do not kill, Do not steal, Do not bear false witness, Defraud not, Honour thy father and mother.

And he answered and said unto him, Master, all these have I observed from my youth.

Then Jesus beholding him loved him, and said unto him, One thing thou lackest: go thy way, sell whatsoever thou hast, and give to the poor, and thou shalt have treasure in heaven…

— Book of Mark

As I suggested yesterday in Part Four, some people might question the use of local taxes and fees to help address a crucial social crisis like housing, and that’s certainly a valid topic of debate.

A fairly common assumption, especially on the political Right, holds that responsibility for the acquisition and maintenance of a dwelling ought to fall to each individual or family, and that government has no business — except perhaps on an emergency — providing or subsidizing housing.

We note, however, that Jesus didn’t advise his followers to sell everything and give the money to the rich.

Traditionally — that is, for the past 100 years — so-called ‘public housing’ projects have been one of government’s approaches to address ‘substandard housing’ and lack of housing. Traditionally, these projects have involved the demolition of older single-family homes, older apartment buildings, older hotels, and surrounding businesses, in order to build government- or nonprofit-managed apartments aimed at low-income and middle-income households.

The federal public housing program started during the New Deal as part of the Housing Act of 1937, and was originally intended to be a jobs program and ‘slums-clearing’ effort. The Public Works Administration (PWA), created under the New Deal to address the country’s housing and infrastructure needs, constructed Techwood Homes in Atlanta, GA, in 1935 as the first federal public housing project. The project evicted hundreds of black families to create a 604-unit, whites-only neighborhood. That same year the Supreme Court ruled the federal government lacked authority to seize property through eminent domain – but local ‘public housing authorities’ did have this authority… allowing them to tear down whole neighborhoods to construct ‘projects’.

Public housing, per se, fell out of favor beginning in about 1974, when President Nixon put a moratorium on federal housing spending for public housing. But expenditures increased for other federal housing programs — Housing Choice Vouchers, Project Based Section 8, Housing for the Elderly (Section 202) and Housing for People with Disabilities (Section 811), and the Low-Income Housing Tax Credit (LIHTC) program.

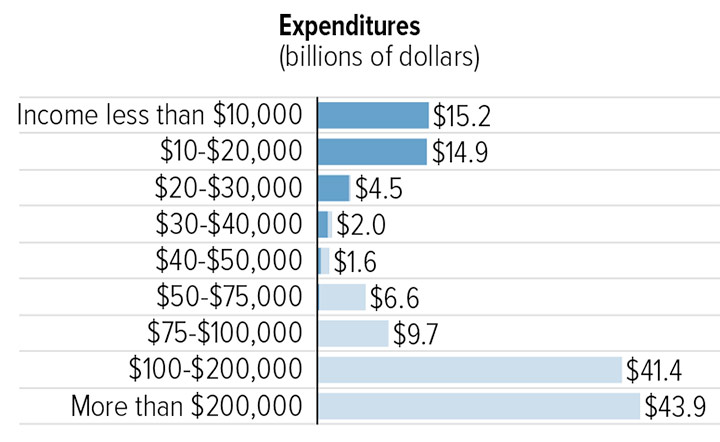

When we compare the federal housing benefits that accrue to poor, renting families… compared to the benefits provided to wealthy homeowners through tax deductions (according to Center on Budget and Policy Priorities)… it would appear that the financial benefits are heavily skewed towards wealthy households.

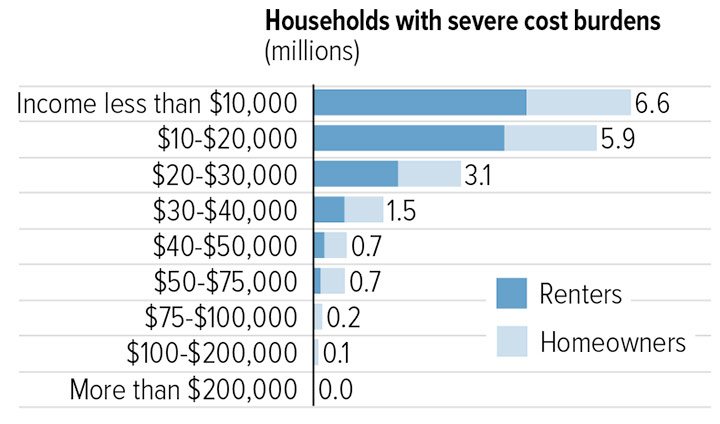

Another chart from the Center for Budget and Policy Priorities refers to households that are ‘severely cost burdened’ — paying more than 50% of their total family income for housing. This chart shows the numbers in ‘millions of households’ suffering from that burden.

(Not ‘millions of people’. Millions of ‘households’. We have about 130 million households in the U.S.)

When our local nonprofit, Pagosa Housing Partners, surveyed mainly working families in Archuleta County, we found the same kind of burdens here in our community. The households with the lowest incomes were most likely to be ‘severely cost burdened’ — often leaving them unable to afford other necessities. Food,. Clothing. Shoes. Medicines. Transportation. And so on.

More and more, here in Colorado over the past 40 years, local governments have recognized the economic damage caused by the lack of workforce housing — as it’s become apparent that federal housing programs have failed to address the growing crisis. The federal subsidies have generally been too little, too late.

Pagosa Springs has been a bit behind the curve, regarding local housing subsidies.

But we’ve been ahead of the curve in subsidizing the tourism industry.

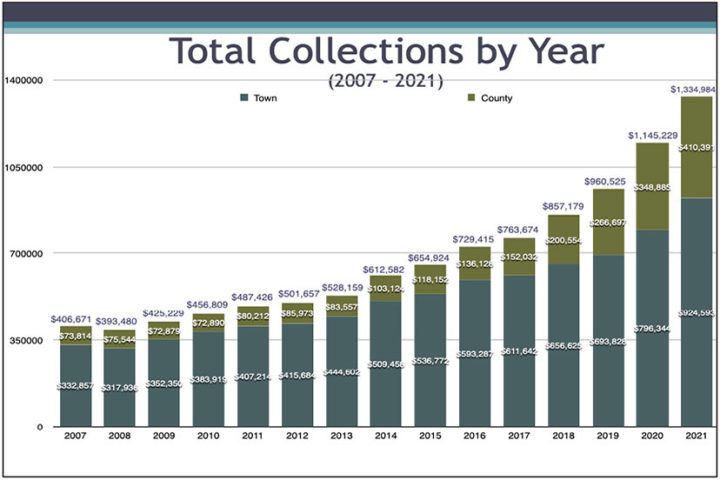

I’ve shared this chart before: the millions of dollars that have been spent by our county and municipal governments to subsidize tourism. Town and County Lodgers Taxes, spent to bring visitors into town.

$10.4 million spent, since 2007.

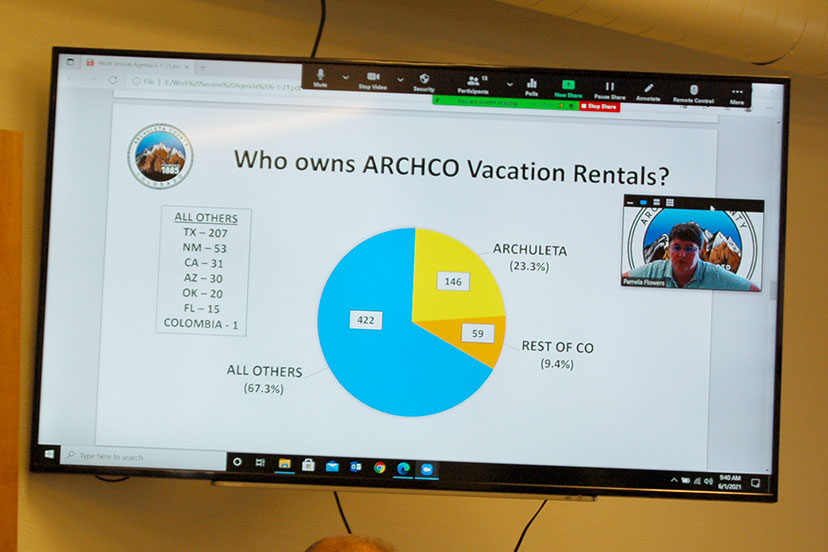

With one unintentional but unfortunate result. 1,200 local housing units in Archuleta County have been purchased by investors, and converted into vacation rentals. Short-Term Rentals. STRs.

In a strange sense, we’ve spent $10.4 million subsidizing the conversion of our limited housing stock into mini-motels, to be operated for profit.

Maybe not the best use of our tax money?