Earlier this week, we shared an essay by Strong Towns founder Chuck Marohn, about how communities finance infrastructure expansion and infrastructure maintenance. Or more accurately, how communities fund infrastructure expansion, and fail to fund infrastructure maintenance. Mr. Marohn has been a consistent advocate for greater wisdom in government spending decisions. Specifically, he has urged government to make investments that actually increase the prosperity of the overall community, rather than investing in projects that, over the long haul, create a financial drain on community wealth.

Mr. Marohn mentions that our state and federal governments are fond of handing out grants to help communities build more jails and schools and highways and parks and trails and other government facilities — but they don’t hand out money for operating and maintaining those grant-funded projects. Instead, the local taxpayers get stuck with the maintenance bill.

Our new court facilities here in Pagosa Springs, for example, are being built with some help from a Underfunded Courthouse Facility Commission grant. That particular commission was established by the General Assembly in 2014 to provide supplemental grant funds to counties in need of financial assistance for courthouse facility projects. In other words, to encourage county governments to abandon their existing facilities and build brand new, debt-financed buildings.

Once the new Archuleta County courthouse is built, however, there are no ‘grants’ to help us out. We’re on our own — to pay off any loans, and to heat and maintain and operate the building.

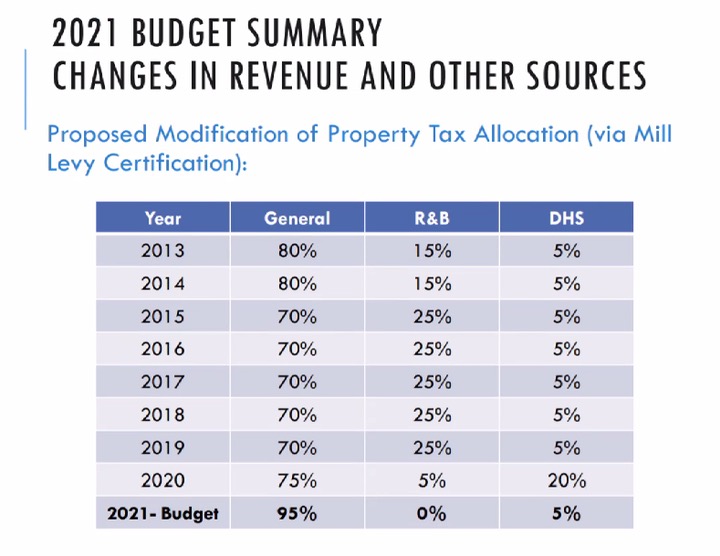

Back in October, our three County Commissioners — Ronnie Maez, Steve Wadley and Alvin Schaaf — listened to their Finance Director, Larry Walton, propose a draft 2021 budget. The presentation was sometimes difficult to understand, watching via ZOOM… But one of Mr. Walton’s numerous charts seemed easy to read.

As we see in this chart, the BOCC has provided variable levels of support for county road maintenance over the past decade. In 2014, when many of our roads were in bad shape, the BOCC was allocating 80% of the property tax to the General Fund, and 15% to the Road & Bridge Fund (shown as “R&B” in this chart, not to be confused with “Rhythm & Blues”.) In 2015, the BOCC came to the (intelligent?) conclusion that our county roads were unlikely to improve unless more tax money were dedicated to Road & Bridge, so they changed the property tax formula and bumped up the road funding to 25% of property tax collections.

Our readers are welcome to consider whether the condition of our roads, in general, were in better shape in 2019 than they were in 2014.

We’re talking about the year 2019… because in 2020, the BOCC reduced the amount of property tax dedicated to Road & Bridge from 25% down to 5%. And as if that weren’t bad enough, the draft budget presented to the BOCC in October reduced the property taxes directed to roads to an even smaller amount. 0%. As in, “zero dollars”.

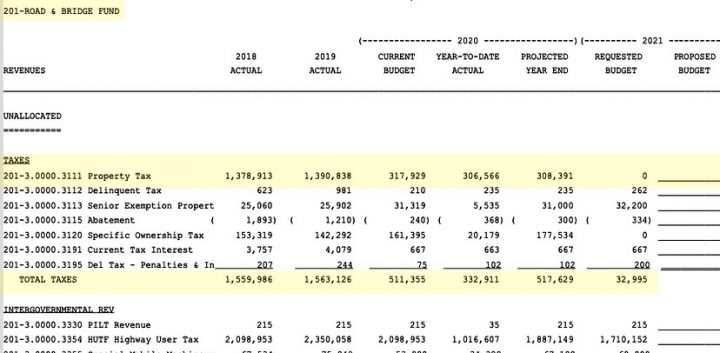

The main source of citizen-generated revenue flowing to Archuleta County — and allocated each year by the Board of County Commissioners — is a property tax mill levy. Mr. Walton did not specifically mention the total amount expected for 2021 during his presentation on Tuesday. That amount was shown, however, in the “Budget Detail” posted to the Archuleta County website, and which you can download here.

Here’s the “Budget Detail” for the tax revenues assigned to the General Fund, in this draft budget of 2021. The top line shows, in the far right column, the expected property taxes requested to be spent in the General Fund: $5.8 million. That number was $3.9 million in 2018.

Below that is the total taxes assigned to the General Fund from all tax sources: $9.7 million. That number was $6.9 million in 2018.

Here’s the “Budget Detail” for the tax revenues assigned to Road & Bridge for 2021. As we can see, the BOCC — in its infinite wisdom — dedicated $1.4 million in property taxes to the Road & Bridge Fund in 2018. For this current year, 2020, the BOCC expects to spend (Projected Year End) about $308,000 from our property taxes on Road & Bridge. According to my pocket calculator, that will be about 20% of the amount they actually spent in 2018.

But the requested budget for 2021? Zero dollars in property taxes.

Here’s a quote from BOCC chair Ronnie Maez, explaining why he wanted to allocate not a single 2021 property tax dollar to our roads in 2021, and why the spending within the General Fund is 39% higher than it was in 2018.

And why you and I are to blame.

“Yeah, you know, we expressed the concerns that we’re anticipating now, to the public. And we tried to do it with the first ballot measure. That failed, and we explained to the public then, that we would have to go for a ‘COP’ for the jail. And the best solution was probably the first solution presented to the public, to get them to vote for a one-percent sales tax, because we were facing all these problems.”

Ah, yes. We’re indeed facing problems, though they might not be exactly the ones Commissioner Maez was thinking about.

These budget numbers were later approved by our commissioners — three commissioners who have agreed, among themselves, to pursue an aggressive “justice center” development project, spending millions of taxpayer dollars on a new (and oversized?) county jail, a new Sheriff’s office (in a remodeled residential house) and a new (oversized?) courthouse in the Harman Park subdivision.

Two of the three commissioners formerly worked in law enforcement, which may help explain their spending priorities for the coming year.

Earlier this week, in Part Two, I wrote briefly about myself and my experiences living in automobile-centric Suburbia as a child, and also about my current situation living in downtown Pagosa Springs where most of my daily needs can be met without turning my car’s ignition. Theoretically at least.

But the condition of our 320 miles of County-government-maintained roads, in a community where the BOCC has dedicated zero property tax dollars to maintenance this year, still has a bearing on my life because (as I wrote earlier) I enjoy visiting friends who live out in the suburban landscape. I do not look forward to the next few years here in Pagosa, if our county tax revenues are going to be funneled — by the current County leadership — into courthouses and jails, at the expense of road maintenance.

But looking further into the future, where is this car-dependent community headed? Have our business and government leaders, unintentionally, been on track to create an unsustainable community?