I mentioned this week’s stock market ‘adjustment’ in Part One, by way of introducing the idea the subject of this editorial series: a chairlift to heaven. The decline continued yesterday, with the Dow falling another half-percent.

I’ve been stuck on a chairlift, on occasion. Momentarily. You’re happily riding up and up, watching the skiers dodging the trees below, when suddenly the chairlift grinds to a halt. And there you are, gently swinging in space, 30 feet above the ground… wondering… who was having trouble getting on or off the chairlift?

How long it will be, before you start moving again? You’re pretty sure it’s only a temporary delay. You’re not too worried.

But what if it’s not temporary? What if the machine is broken? How long would you be left hanging there, getting colder and colder, before a rescue crew could arrive?

Would you take a chance… and jump? 30 feet to the ground? You look down and mentally calculate your chances…

We all watched the machine known as the “Growth Economy” come to a grinding halt between December 2007 and June 2009, during the Great Recession — a generally unpleasant period of time, often regarded as the second-worst economic downturn in modern US history. Most analysts seem to blame the crisis mainly on greedy bankers and mortgage lenders making billions of dollars in profit by issuing fraudulent mortgages to millions of unqualified borrowers. Instead of going to jail, the bankers were bailed out by US taxpayers.

Many of the victims, meanwhile, are still homeless, living in cars, or paying exorbitant rents for substandard housing. Or so I’ve heard.

Who was responsible for this global debacle? Has anyone stepped up and apologized? If so, I haven’t heard about it.

But as America has climbed, slowly, out of the bomb crater, many people have been delighted to claim credit for the “improved” economy. When President Trump took office in January 2017, he inherited an economy in its eighth year of economic expansion. The reported growth has continued into the winter of 2020, making it the longest period of sustained economic growth in US history (dating back to the 1850s.) The growth hasn’t been terribly dramatic, but steady.

So how’s the Middle Class doing? We know that the rich are getting richer, and I guess that’s what they do best. But the Middle Class… maybe they’re on the wrong chairlift?

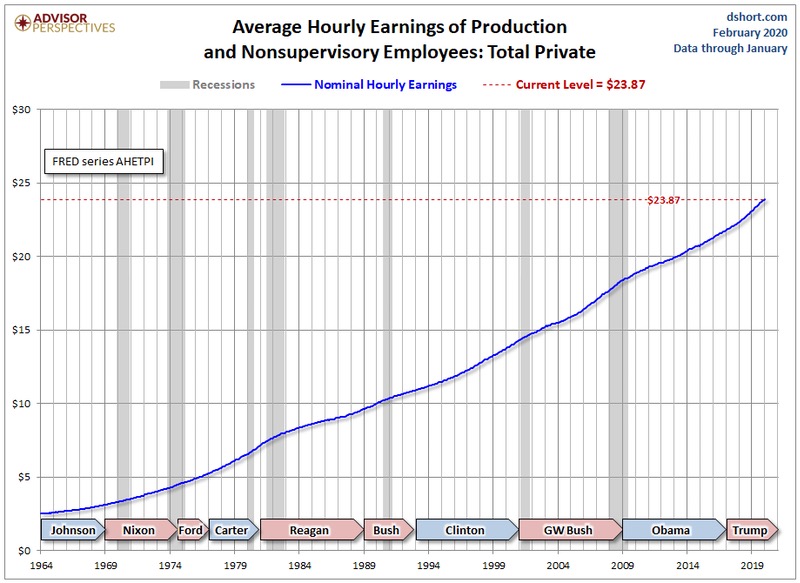

Back in 1964, when Lyndon Johnson was president, the average (and thus, Middle Class) American wage was about $2.50 per hour. As of January 2020, the Federal Reserve Bank pegged the average hourly wage at $23.87. The steady increase in the average wage seemingly had no relationship at all to the economic policies of the Republican or Democratic administrations holding fort in Washington DC — with those various administrations shown at the bottom of the chart.

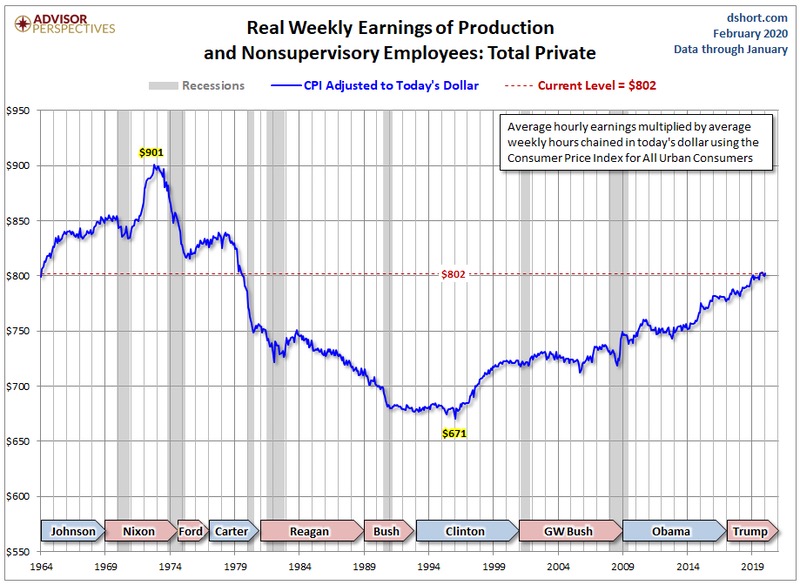

But that’s not the whole story. The value of the dollar has changed since 1964, due to inflation and other factors, and the average worker no longer works 40 hours a week. More like 34 hours, on average. So the take-home pay has changed.

The folks at AdvisorPrespectives.com published some charts (like the one above) two weeks ago, and one of those charts shows the average (Middle Class) worker’s wage, when adjusted for inflation, and for the fewer average number of hours worked.

According to their data, the average American worker is earning about 11 percent less than he or she was making in the early 1970s, and about the same, as an adjusted number, as he or she was making in 1964. Once again, the Presidential administrations are shown at the bottom of the chart, and once again, there’s no obvious correlation between “Democratic” or “Republican” administrations and the economic fate of the Middle Class. Historically speaking.

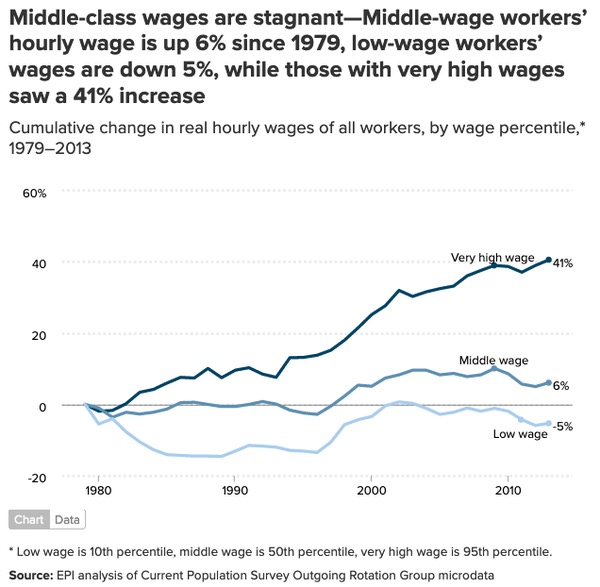

The Lower Class worker was earning less money in 2013 than in 1979 — adjusted for inflation — according to the Economic Policy Institute. Like, 5% less.

Not exactly an economy anyone should be bragging about, perhaps… when looked at from a certain perspective. But things could be worse, of course… and they certainly are, in some areas of the US… and in some other countries.

But maybe things are looking up, for example, in China — in spite of an ongoing trade war? A September 2019 article on the CNBC website, written by reporter Evelyn Cheng — “China’s giant middle class is still growing and companies from Walmart to start-ups are trying to cash in” — suggests that the economic chairlifts in that Asian nation are carrying more and more people up, and up, into the Middle Class:

It’s all a bet on the Chinese middle class, a consumer force McKinsey analysis predicts could reach 550 million in three years — that’s more than one-and-a-half times the entire US population today.

American consumer giants and a slew of Chinese companies are now angling for a piece of the largest middle class market in the world.

Meanwhile, back at home in the US, the Middle Class appears to be riding downhill. The same thing seems to be going on in Europe. According to data released last year by the Paris-based Organization for Economic Cooperation and Development, inflation-adjusted disposable incomes for the global middle class have not grown since the middle of last decade, while incomes for the top 10% are hitting new highs. Some media reports refer to the “shrinking” of the American Middle Class.

The middle classes are getting squeezed particularly hard by the rising costs of education, health care and housing, the OECD writes. College costs are up, in the US and elsewhere. Homes are much more expensive relative to incomes.

So how about that big Colorado Department of Transportation (CDOT) project scheduled for this summer in the center of downtown Pagosa Springs? I mentioned that project briefly in Part One, yesterday, and suggested that it sounds like an unpleasant development — for travelers, local residents, and perhaps, especially, downtown businesses.

It’s easy to understand why CDOT needs to do this project, eventually. They’ve been talking about it for almost a decade, after determining that the large culverts that carry the flow of McCabe Creek are in poor shape, and additionally, would not handle a large flood event successfully.

And we also note that Highway 160 is the only major east-west highway running through this part of southwest Colorado.

Sounds like a responsible course of action, even after a decade of delay. And what we’re talking about here is “responsibility”…