It’s certainly tempting to focus on one single aspect of the electric car (EV) debate, and ignore the overall complexity of the situation.

No doubt some Daily Post readers feel uncomfortable with the idea that (presumably wealthy) folks purchasing or leasing a high-priced battery-powered car can qualify for a federal tax credit, while the rest of us have to pay full price for our gasoline cars… maybe even more than full price.

And now we hear the Town Council considering the idea of using state and local taxes to underwrite a new “Tier Two” fast-charging station at Centennial Park, and subsidize the electricity that those EV owners will add to their batteries.

Let’s talk about that.

In 1966, a company called Edmunds Publications began publishing booklets to help car shoppers understand automobile specs and pricing, and make better buying decisions. The company began the transition to the Internet in 1994, and rolled out the website Edmunds.com in 1995. On the Edmunds.com website you can find an article titled, “Electric Vehicle Tax Credits: What You Need to Know”:

You’ll often hear that a credit is worth “up to” a certain amount. “Up to” is the critical modifier. The federal incentive is usually referred to as a flat $7,500 credit, but it’s only worth $7,500 to someone whose tax bill at the end of the year is $7,500 or more. Let’s say you buy a Nissan Leaf or other eligible vehicle and you owe $5,000 in income tax for a particular year. That’s all the tax credit will be. Uncle Sam will be not writing a refund check for the other $2,500. And an unused portion of the credit can’t be applied against the following year’s taxes.

If you are leasing the vehicle, the tax credit goes to the manufacturer that’s offering the lease, not you. The carmaker will likely factor the credit into the cost of the lease to lower your monthly payment, but it isn’t mandatory.

The credits also are based on the electric car’s battery size. For some models, the maximum can fall well below $7,500. For example, the Toyota Prius Prime, a plug-in hybrid hatchback, only qualifies for a $4,502 federal tax credit.

The electric vehicle tax credits are being phased out, however, based on the idea that new technologies have high start-up costs, but become more profitable as products are mass produced and sales increase. In the case of electric vehicles, the federal tax credits are expiring for each manufacturer when they sell 200,000 qualified vehicles. Tesla was first to hit that milestone, in July 2018. As a result, Tesla vehicles delivered from January 1 to June 30, 2019, were eligible for a reduced federal credit of $3,750 — and were then eligible for a credit of $1,875 through December 31, 2019.

Tesla cars no longer qualify for the federal credit.

GM became the second carmaker to sell 200,000 qualified plug-in vehicles, and the maximum credit dropped to $1,875 for the period from October 2019 through March 2020. After next month, there will be no federal credit for a qualified vehicle from GM. Nissan is next in line for a credit phaseout, but it’s still about 70,000 vehicles away from the 200,000 mark.

Governments have various clever ways of providing economic benefits, however. Tax credits are merely one technique. Restrictive or permissive regulations are another.

Take, for example, manufacturer Tesla, maker of the nation’s best selling electric vehicle, the Model 3. Although Tesla has showrooms in many US states, customers can buy vehicles only from the Tesla website. The showrooms allow people to learn about the company and its vehicles, but 48 states have laws that limit or ban manufacturers from selling vehicles directly to consumers — forbidding, for example, any discussion of pricing or financing — and dealership associations in multiple states have filed lawsuits over Tesla’s sales practices.

Countries other than US do not protect car dealers, and the Federal Trade Commission has recommended allowing direct manufacturer sales, which some analysts believe would save consumers 8% in average vehicle price. To put that number into perspective, the average new gas-powered car costs about $40,000, meaning that here in Colorado you may be paying a $3,200 premium — enforced by state law — for the privilege of having an independent dealer handle the sale.

Are we paying more than full price for that Chevrolet?

Maybe so. And in more ways than one.

The company known as General Motors has been subsidized by local, state and federal taxpayers for a few decades now. According to the website GoodJobsFirst.org, General Motors has received government subsidies totaling about $57.2 billion since 1984, with most of that amount paid out during and following the Great Recession. That’s billion with a “B” — about $454 per US household.

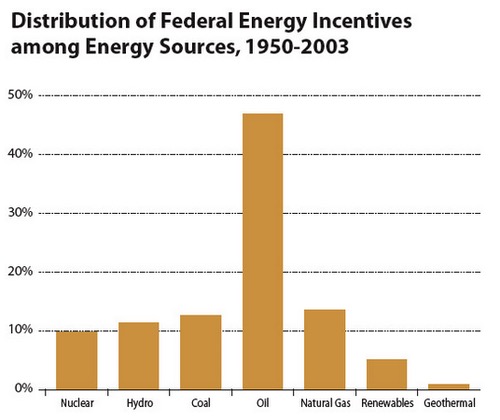

A 2017 study by the consulting firm Management Information Services, Inc. (MISI) estimated the total historical federal subsidies for various energy sources over the years 1950–2016. The study found that oil, natural gas, and coal received $414 billion, $140 billion, and $112 billion respectively, or 65% of total energy subsidies over that period. (2015 dollars). Oil, natural gas, and coal benefited most from depletion allowances and other tax-based subsidies, but oil also benefited heavily from regulatory subsidies — exemptions from price controls and higher-than-average rates of return allowed on oil pipelines.

An earlier 2003 survey by MISI generated this chart, showing that almost half of all federal energy subsidies went to the oil industry:

The MISI report in 2017 found that non-hydro renewable energy (primarily wind and solar) benefited from $158 billion in federal subsidies, or 16% of the total, largely in the form of tax policy and direct federal expenditures on research and development (R&D).

But the subsidies calculated by MISI did not include the cost of protecting American oil company access to the massive oil fields located in the Mideast.

From a November 2019 study by professor Neta Crawford,Chair of the Department of Political Science at Boston University, entitled “United States Budgetary Costs and Obligations of Post-9/11 Wars” (which you can download here):

Since late 2001, the United States has appropriated and is obligated to spend an estimated $6.4 Trillion through Fiscal Year 2020 in budgetary costs related to and caused by the post-9/11 wars — an estimated $5.4 Trillion in appropriations in current dollars and an additional minimum of $1 Trillion for US obligations to care for the veterans of these wars through the next several decades…

Just to put a $7,500 EV tax credit into some kind of perspective, we will note again that the EV tax credits are expiring.

While the wars continue.