“This is totally a rehearsal for future efforts, and I think we are learning how to do this in the current political climate…”

— Scott Wasserman, President of the Bell Policy Center, speaking in support of Proposition CC, as quoted in the Colorado Sun, October 3, 2019

If your long-range intention were to get voters to repeal the Taxpayers Bill of Rights (TABOR), you might be hard-pressed to arrange a better “rehearsal” process than Proposition CC, one of the two state propositions that will appear on Colorado’s November mail ballot, scheduled to begin landing in voters’ mailboxes next week.

We briefly discussed Proposition DD earlier, in our October 2 editorial.

The rehearsal for the repeal of TABOR is off to a rather late start? The opponents of Proposition CC have been relatively active ever since the General Assembly voted last April to place the issue before the voters. The campaign to promote a ‘YES’ vote, meanwhile, didn’t kick off until last week — October 2 — at a gathering in Denver that featured Gov. Jared Polis; University of Denver Chancellor Emeritus Dan Ritchie; State Rep. Kevin Priola; MSU Denver President Dr. Janine A. Davidson; and Great Education Colorado Executive Director Lisa Wiel.

Proposition CC would eliminate individual TABOR state taxpayer refunds in favor of keeping additional state revenue in Denver, to be “equally distributed” among public schools, higher education, and infrastructure projects. When the voters approved TABOR in 1992, the constitutional amendment required all governments to refund excessive tax collections to the taxpayers whenever government revenue grew faster than population plus inflation — but the amendment also allowed municipalities, counties and special districts to “de-Bruce”, with voter approval, to allow the government entities to keep and spend the excess revenues rather than issuing refunds. Since 1992, almost all the municipalities in Colorado — including the Town of Pagosa Springs — have de-Bruced. The Archuleta County government was de-Bruced temporarily between 2006 and 2011.

The state government has never been fully de-Bruced. At least, not permanently. Colorado taxpayers appreciate the taxing and debt limits imposed on the state government by TABOR, but we aren’t unreasonable about it. We understand that times change, and need change. We understand that nothing is “forever.”

For example. The voters approved Referendum C in November 2005, a ballot measure that had broad bi-partisan support including endorsements from the business community, the Republican governor, and the Democratic legislative leadership. Referendum C suspended the TABOR revenue limit for five years, and changed the growth factor to apply to “the prior year’s limit” rather than to actual revenues. Referendum C also earmarked the additional revenue that would exceed the TABOR limit to specific types of spending — education, transportation, and payments into pension programs for public employees. To make the referendum a bit more attractive to voters, it mandated a temporary decrease in the income tax rate in 2011 from 4.63% to 4.5%.

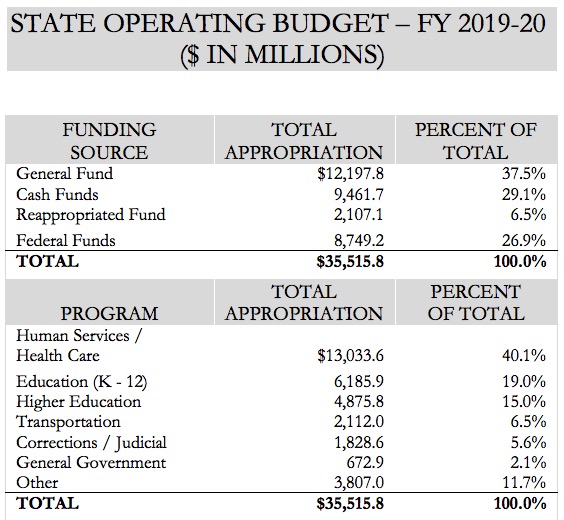

As noted, education and transportation funding were specifically called out by Referendum C. How have those funding priorities faired since? For 2006-2007, the Colorado budget for public K-12 education was $3.8 billion. For 2019-2020, the education budget is $6.1 billion.

In 2006-2007, the Department of Transportation had a budget of $1.0 billion. For 2019-2020, the budget is $2.1 billion.

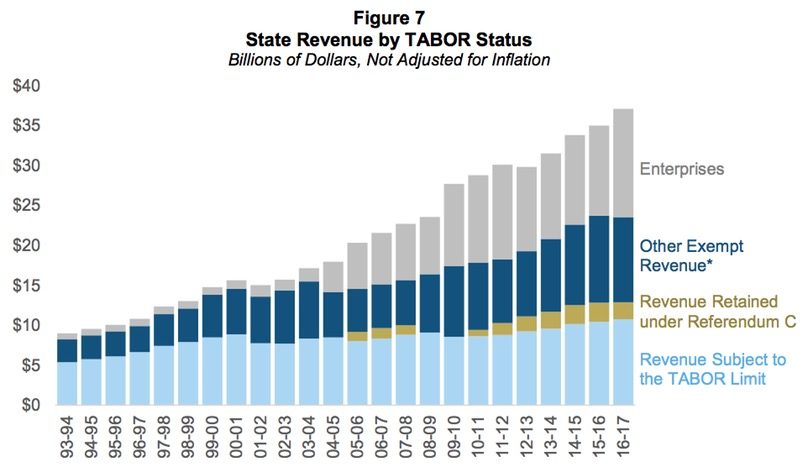

As a result of Referendum C, state government spending has greatly increased since 2006 — as indicated in the chart below, found in the “New Legislator Orientation Information Paper” published by the Colorado Legislative Staff in December 2018. (You can download that document here.)

We note that, in 2016-2017, more than 69 percent of Colorado state revenue was exempt from TABOR limitations, for various reasons.

Exactly why a state government could serve its citizens with $16.3 billion in 2006, but can’t seem to serve its citizens with $35.5 billion in 2019… well, we don’t have a clear explanation for that discrepancy.

My personal income is actually considerably lower today than it was in 2006, and I think I’m just as happy with my life. Maybe happier. But maybe governments are never happy, no matter how much money we hand over.

According to ‘Yes on Prop CC,’ the measure would allow Colorado to “attract and keep quality teachers,” “make community colleges and trade schools more affordable,” and “repair unsafe bridges and crumbling roads.” But the promise to spend the money on education and roads is merely that — a political promise. Future legislatures can legally alter how the money is spent, and opponents of the proposition are predicting they will do precisely that.

Unlike Referendum C, this new request would not expire in five years. Proposition CC would permanently remove the TABOR limits on spending and allow the General Assembly to spend all the tax money the state collects, forever ending the possibility of TABOR refunds. Curiously, the language approved for the ballot does not mention “TABOR” at all. Here’s the wording you will see on your ballot:

WITHOUT RAISING TAXES AND TO BETTER FUND PUBLIC SCHOOLS, HIGHER EDUCATION, AND ROADS, BRIDGES, AND TRANSIT, WITHIN A BALANCED BUDGET, MAY THE STATE KEEP AND SPEND ALL THE REVENUE IT ANNUALLY COLLECTS AFTER JUNE 30, 2019, BUT IS NOT CURRENTLY ALLOWED TO KEEP AND SPEND UNDER COLORADO LAW, WITH AN ANNUAL INDEPENDENT AUDIT TO SHOW HOW THE RETAINED REVENUES ARE SPENT?

I suppose an independent audit could show us “how the retained revenues are spent.” Would the audit show us how effectively these billions of dollars in “retained revenues” had been spent? I doubt it.

Would an independent audit show us how the General Assembly has redirected the remainder of the budget — the additional billions of dollars we gave them that weren’t part of the “retained revenues”? Probably not.

Would Proposition CC actually raise taxes? No. Would it permanently eliminate TABOR refunds, when state tax collections exceed the rates of inflation and population growth? Yes.

Is there a guarantee the money will actually go towards education and transportation? No.