Tax Increment Financing (TIF) and ‘Urban Renewal Authorities’ are a fairly common feature in Colorado cities and towns, but they aren’t well understood by most people.

Potholes and failing pavement are also increasingly common. We understand potholes, and we understand that our local governments love to spend on new facilities for their employees, and give away money for ‘economic development’ … while the potholes remain.

But it’s widely believed, by many local leaders, that there could be no causal connection between Tax Increment Financing (TIF) and the various other forms of ‘economic incentives’ — on the one hand — and potholes and failing pavement on the other.

Or rather, it’s widely believed that TIF financing and and government ‘incentives’ provided to large corporations are a solution to our worsening infrastructure and the declining economic prospects for ordinary working people in Colorado.

Yet, as TIFs and incentives become more and more common, the other problems become worse. Go figure.

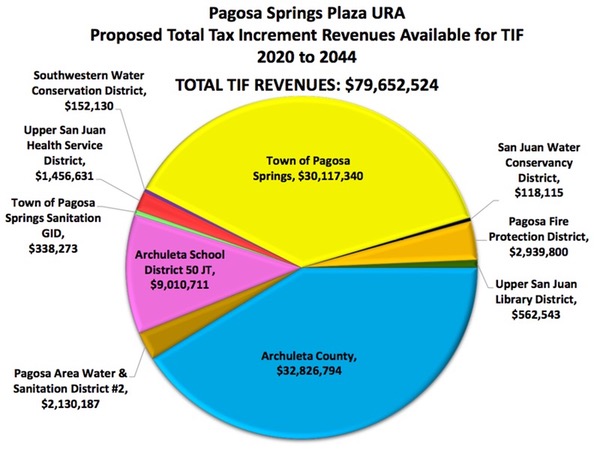

While researching TIF financing over the past few weeks, I learned that some of the ‘incentives’ in typical TIF projects come from the local school district mill levy. Instead of going into public education, these property taxes are redirected — for up to 25 years, in some cases — to help the developer make a profit on his project. In the case of the Springs Resort ‘Urban Renewal Area’ proposal, up to $9 million would be directed away from the Archuleta School District (ASD) to pay back the Springs Resort for its investment in new streets and utilities. You see that number in the ‘pink’ pie slice.

The Colorado Urban Renewal Law allows for this redirection of taxes — when we have problems with ‘slums’ and ‘blight’ — but the TIF rules require the Colorado Department of Education to ‘backfill’ the missing school tax revenues from its state budget. So if the Springs Resort got their TIF financing plan approved, ASD will still get its $9 million — but the Colorado Department of Education will essentially lose $9 million. Can we imagine how many millions of dollars have disappeared, and are still disappearing, out of the state’s public education budget, to pay for developer ‘incentives’ in Denver alone, with its 53 urban renewal projects?

We don’t have to imagine it. The number was researched by the Independence Institute for its 2016 report, The Empty Promise and Untold Cost of Urban Renewal in Colorado. (You can download that report here.)

$20.7 million was backfilled by the Department of Education, in 2013-2014 alone, to accommodate the taxes used for ‘Urban Renewal’ incentives in Denver. If a TIF typically lasts for 25 years, that could add up to more than half a billion dollars… directed away from Colorado’s public education… to develop ‘blighted’ properties in one single city: Denver. But most of the ‘blighted’ properties in Denver were never ‘slums’ in any true sense of the word. Denver has been using the Colorado Urban Renewal Law to fund something it was never intended to fund: economic development that has no connection to ‘blight.’

As a result, Denver is now a city where developers get reimbursed… but working families typically pay 50% of their household income for housing.

Will the ‘blighted’ property just south of the Springs Resort now contribute to this ‘incentive’ system? And will Pagosa end up just like Denver?

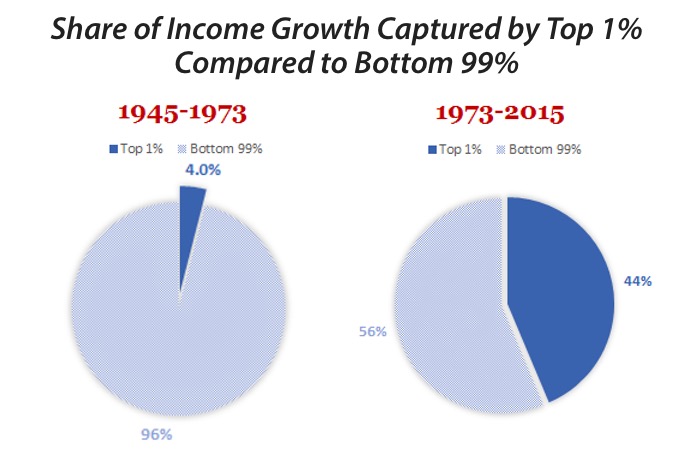

I began this article series, last week, by sharing a Colorado Center for Law and Policy (CCLP) graph:

The proportion of Colorado’s wealth that accrues to everyday citizens has shown a dramatic decline since 1973, while the proportion going into the pockets of the very wealthy has greatly increased.

It’s one thing to talk about the wealthiest One Percent in a general way. We can also talk about the wealthiest One Percent in a small, rural town. Here in Pagosa Springs, population 13,500, the wealthiest One Percent consists of approximately 135 people. This would be a small group of people who, according to CCLP, have acquired nearly as much wealth as the other 13,350 people combined. Our economic and political systems have not only allowed this disparity; our economic and political systems actually encourage this disparity.

I cannot say that the owners of the Springs Resort belong to the One Percent. That may be the case, or it may not. But I can say with considerable confidence that the $6.6 billion in ‘business incentives’ handed out by the state of Colorado and by local governments each year has been distributed largely to the some of the wealthiest individuals among us, while many of us here in Archuleta County have seen our wages stagnate, and the cost of our housing skyrocket.

The seven members of the Town Council have been handed a difficult job by the owners of property on Hot Springs Boulevard. Developer Jack Searle is owner of 27 vacant acres of rock meadow that has never been developed and does not, in my humble opinion, align with the intentions of the Colorado Urban Renewal Law — CRS 31-25 — for government subsidies. He has stated in a public meeting that he does not intend to make a financial investment in the development of the vacant land. I don’t fully understand, therefore, what role Mr. Searle’s construction company, BWD Construction, would play in a future development.

David Dronet, principal at the Springs Resort, has been the person pushing hardest for a municipal ‘Urban Renewal Authority’ and for $79.7 million in projected tax incentives. During his presentations, he has assured us that no development will take place on the vacant land without TIF financing to reimburse the development costs of streets and infrastructure.

And Mr. Dronet has appeared extremely confident that, should a TIF be provided, then he and his investors will finance hundreds of new commercial and residential buildings adjacent to the existing Springs Resort.

So part of the complexity facing the Town Council is discovering whether, based on his past history, David Dronet is likely to become the savior of Hot Springs Boulevard. Or whether this would be come just another struggling, mostly vacant subdivision, funded partly by the taxpayers.