Instead of pointing fingers and laying our blame at CDOT or a private company for our transportation funding woes, let’s point the finger squarely where it belongs: TABOR.

— from the opinion piece by Carol Hedges, “Opinion: Want to blame someone for our crumbling roads? Try TABOR” in the Colorado Sun, July 21, 2019.

Last month, the Colorado Supreme Court gave the green light to a controversial ballot measure that would fully repeal Colorado’s Taxpayer’s Bill of Rights… also known as TABOR… also known as Article X, Section 20 of the Colorado Constitution.

TABOR was approved by Colorado voters in 1992 to create limits on the growth of government spending at all levels of government in the state. Here’s its preferred interpretation, as stated in the amendment’s General Provisions:

Its preferred interpretation shall reasonably restrain most the growth of government. All provisions are self-executing and severable and supersede conflicting state constitutional, state statutory, charter, or other state or local provisions. Other limits on district revenue, spending, and debt may be weakened only by future voter approval…

It also requires voter approval for all tax rate increases and all new taxes. That provision has been popular with taxpayers over the past 27 years, as has the TABOR requirement that the voters approve, in advance, new government debt.

The Supreme Court’s recent decision hinged on whether the proposed ballot measure violated the state’s requirement that ballot measures address a single issue, a standard approved by the voters in 1994.

“The initiative could not be written more simply or directly,” Justice Richard Gabriel wrote for the majority. “It essentially asks voters a single question: should TABOR be repealed in full?”

In her dissenting opinion, Justice Monica Márquez said the majority’s opinion “profoundly weakens” the single subject requirement. She wrote:

“To offer an extreme example, under the majority’s logic, voters could repeal our state constitution’s entire Bill of Rights through a single initiative and do away with religious freedom, free speech, protections against unreasonable searches and seizures, the right to bear arms, the prohibition against cruel and unusual punishment, and due process, among a host of other rights…”

The Court’s ruling overturned an earlier decision by the State Title Board, and will allow the groups backing the repeal — including the left-leaning Colorado Fiscal Institute — to collect signatures aimed at putting the initiative on the 2020 ballot.

Many people desperately dislike TABOR. Judging by past writings — including the Colorado Sun opinion piece linked at the top of this article — Carol Hedges, Executive Director of the non-profit Colorado Fiscal Institute, is among them.

The Colorado taxpayers — the ordinary folks who don’t spend a lot of time worrying about fiscal policies, but who might worry about the unchecked growth of government — seem to appreciate the taxing and debt limits imposed by TABOR. But we also can be reasoned with.

Following the recession of 2001-2003, the voters approved Referendum C in November 2005. Referendum C had broad bi-partisan support including endorsements from the business community, the Republican governor, and the Democratic legislative leadership. It suspended the TABOR revenue limit for five years, and changed the growth factor to apply to the prior year’s limit rather than actual revenues. Referendum C also earmarked the additional revenue that would exceed the TABOR limit to specific types of spending, including education expenditures, transportation financing, and payments into pension programs for public employees. To make the referendum a bit more attractive to voters, it mandated a temporary decrease in the income tax rate in 2011 from 4.63% to 4.5%.

We might note that “transportation financing” was among the government sectors specifically called out by Referendum C.

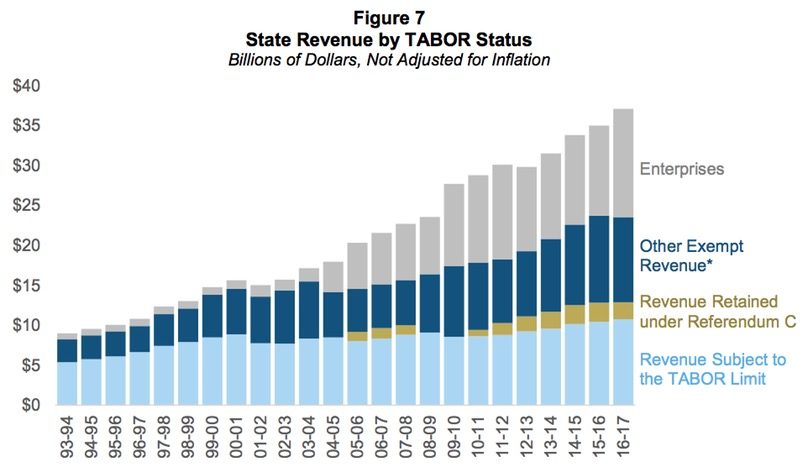

As a result of Referendum C — approved by the voters — state government spending has greatly increased since 2006 — from about $21 billion in 2006-2007 to about $37 billion in 2016-2017, as indicated in the chart, below, found in the “New Legislator Orientation Information Paper” published by the Colorado Legislative Staff in December 2018. (You can download that document here.)

We’ll be looking more closely at this chart tomorrow in Part Three, but please note for the time being that, in 2016-2017, more than 69 percent of Colorado state revenue was exempt from TABOR limitations, for various reasons.

The folks supporting a repeal of TABOR on the 2020 ballot probably have an uphill battle ahead of them. A full repeal of Article X, Section 20 would presumably allow every level of government in Colorado, from the state government down to the local library district, to increase tax rates without voter approval — rates of income taxes, property taxes, sales taxes, fuel taxes, cigarette taxes, lodging taxes, marijuana taxes, liquor taxes, etc. — and would also be allowed to create new never-before-seen taxes on whatever goods and services, without voter approval. A full repeal would also allow all levels of government to create new government debt without voter approval. (Something the banking industry would greatly appreciate, no doubt.)

Ms. Hedges wants us to repeal TABOR, and she apparently also wants us to believe that TABOR is to blame for the condition of our state highways and county roads. I’m not sure how many Colorado residents saw their family budgets increase by 75% between 2007 and 2017, but it appears that the State of Colorado grew its own budget by that amount. (On our behalf, of course.)

I respect Ms. Hedges and her friends; I’m sure they honestly feel that the repeal of TABOR would be good for Colorado. But we need to ask ourselves. If the Colorado state government spent 75% more in 2017, compared to 2007… and if 69% of the spending was exempt from TABOR limitations… should we blame TABOR for the condition of our roads and highways?

Or does our state government simply have a problem managing our money properly?